Q4 2025 Quarterly Newsletter

The growth potential of a company is a key driver of its stock price. A higher growth rate of earnings will often result in a higher price to earnings multiple (what investors are willling to pay for a dollar of earnings). Consistency of earnings growth also adds to a company's appeal and generally warrants a higher multiple.

At the end of 2025, stocks are back to near record levels after recovering from fears that expectations about artificial intelligence (AI) have outstripped the potential profits. Whatever the outlook over the next several months, there is a general consensus that AI will have durable impact on innovation, efficiency and access to data.

Companies pursue growth in two ways: organic and inorganic. Organic growth is achieved through a company’s own internal resources and capabilities, such as research and development expense to create new or refreshed products, advertising expense to drive customer demand and capital expenditures to add or expand plants and distribution facilities. Organic growth has several advantages including maintaining a consistent corporate culture and investment in the company’s core knowledge area; and generally, it is a lower risk alternative to acquisitions. The downside is that this growth is often slower to materialize than acquired (inorganic) growth.

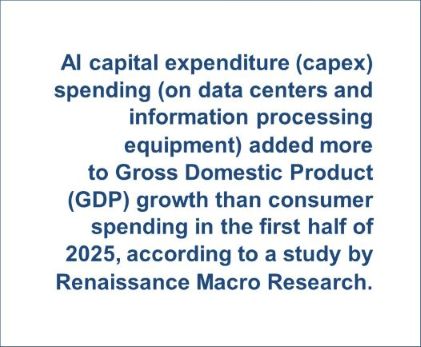

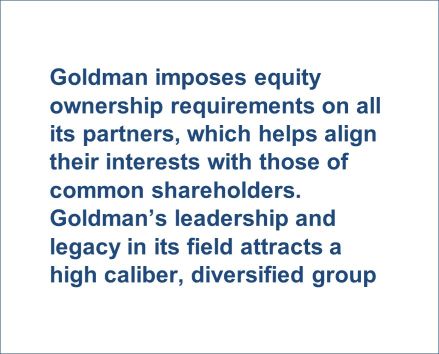

U.S. capital spending is estimated to reach $3.4 trillion this year fueled by capital expenditures toward AI infrastructure and the passage of the “One Big Beautiful Bill Act.” AI capital expenditures (capex) spending (on data centers and information processing equipment) added more to gross domestic product (GDP) growth than consumer spending in the first half of 2025, according to a study by Renaissance Macro Research. Projections for AI spending are climbing with the consensus estimate at year end now at $527 billion, up from the previous estimate of $465 billion at the start of the third quarter.

The comprehensive tax bill will potentially serve as an additional accelerant to capital spending as it will allow companies to deduct 100% of the depreciation of any qualified project in the first year it goes into service.

Inorganic growth is external growth – primarily mergers, acquisitions or strategic partnerships. Mergers and acquisitions often present challenges of integration, melding different cultures and combining systems and processes. Sometimes management gets distracted by these challenges from its core business, causing performance to suffer during integration periods. In addition, many acquisitions are financed through debt, which limits future strategic flexibility and increases financial risk. Competition for attractive acquisition targets can sometimes drive purchase prices well above their economic value, increasing pressure to extract synergies that may never fully materialize.

As a result, a recent study by a professor emeritus of accounting and finance at New York University’s Stern School of Business conducted on over 40,000 corporate acquisitions over the last four decades determined that 70% of mergers fail. This failure rate is consistent with other studies previously cited in the Harvard Business Review. These studies define success as a higher stock price two or three years after the merger with the absence of goodwill write-offs.

Incentives for CEOs to pursue acquisitions despite the high failure rate exist as compensation is often tied to the size of the organization being managed. The misalignment often results in shareholders being worse off while the bidding CEOs are better off. A good example was the $27 billion purchase of Refinitiv by the London Stock Exchange Group (LSEG) in 2021, which tripled the acquirer’s revenue. David Schwinmmer, the CEO of LSEG, was given a 25% increase in base salary “to reflect the LSEG’s increased size following the Refinitiv purchase.” Following the purchase LSEG shares fell 25% on concerns of lower synergy expectations from the acquisition.

Actively managed portfolios afford the opportunity to assess growth and the allocation of capital and investment by managements and boards. Although stocks look expensive by some measures, the elevated level of capex spending represents an investment in the future, which has the potential for higher productivity growth and increased profitability. While growth from capex takes longer to materialize, this level of spending could portend well for long-term economic growth and future value creation.

Company Comments

Comments follow regarding common stocks of interest to clients with stock portfolios managed by Delta Asset Management. This commentary is not a recommendation to purchase or sell but a summary of Delta’s review during the quarter.

Carrier Global Corporation { CARR }

Carrier is a leading provider of HVAC, refrigeration, fire and security solutions. The company’s products promote smarter, safer and more sustainable buildings and infrastructure and help to effectively preserve the freshness, quality and safety of perishables across a variety of industries. Carrier began operating as an independent company as part of a spin-off from United Technologies (UT) in 2020. The company is led by David Gitlin who previously served as CEO of UT’s Collins Aerospace unit. Carrier has an extensive global footprint with approximately 48,000 employees, including 3,600 engineers. Its products and services are sold in over 160 countries worldwide.

The primary strength of Carrier is found in its HVAC segment, which provides heating and air products, controls and solutions. The company’s strong brands, leading positions and scale provide it with a distinct advantage. The company is a top player within both residential and commercial unitary systems. Originally founded in the early twentieth century, Carrier has built its leading positions through a record of innovation, which continues today. Since 2014, it has increased its engineer count by 20% to 3,600 and holds approximately 12,000 active patents. Much of this innovation is driven by trends in reducing the carbon footprint and digitalization of products from automation and predictive maintenance. Carrier has released 200 new products in just the past couple of years.

The company’s broad range of product and service offerings, reputation for quality and innovation and its industry leading brands make it a trusted provider for critical applications in the construction, transportation, security, food retail and pharmaceutical industries among others. According to the company, Carrier is focusing investments toward developing smart, sustainable and efficient solutions for megatrends of urbanization, climate change, increasing requirements for food safety driven by the food needs of our growing global population, rising standards of living and increasing energy and environmental regulations.

Carrier’s large installed base and growing aftermarket revenue mix accounts for more than 20% of consolidated revenue. This position reduces cyclicality and generates recurring revenue over the lifetime of these systems.

The company made a significant acquisition in 2024, buying the Viessmann Group. Headquartered in Germany, Viessmann manufactures and sells heat pumps, boilers, as well as solar photovoltaic and battery products and services. The purchase will bolster the company’s footprint in Europe and cement the company’s largest share position of the commercial heat pump in Europe.

A slowdown in commercial construction and new housing starts is a cyclical risk facing Carrier and the industry. The company’s strong market position has typically led to a strong recovery after a downturn in building activity. Though typically rational, competition will be an ongoing challenge. Carrier faces reputable competitors that continue to invest to improve their own product lines.

We believe Carrier can grow revenue in the low-single digits annually over the next decade. At this pace of growth, we believe cash flow margins will gradually improve to 8.0% plus over time. Based on these assumptions, our stock valuation model indicates Carrier’s current price offers a long-term average annual rate of return of approximately 8.07%.

Sysco Corporation { SYY }

Founded in 1969, Houston-based Sysco is the largest food service marketing and distribution company in North America. Sysco’s major customers include independent restaurants as well as schools, colleges, hotels, hospitals and other food service outlets. Sysco holds about a 17% market share (two times its largest competitor) in the $350 billion plus food service market in the U.S. and Canada.

Sysco targets full service independent restaurant operators. The company has nearly a 30% market share among this group. Sysco focuses on independent restaurants where it has a relatively higher degree of pricing power

versus chain restaurants. Historically, Sysco has been able to pass along inflation adjustments without significant delays. Key drivers in the industry include prompt and accurate delivery of orders, competitive pricing, close contact with customers and the ability to provide a full array of products and services to assist clients in their food service operations. Sysco’s distribution network and scale are competitive advantages in an industry with high fixed costs, helping the company generate industry leading returns on invested capital.

Sysco has the largest marketing and sales organization within the food service industry, which is a key differentiator. The company advises clients on how they can drive sales and minimize costs. Sysco specializes in assessing business operations and providing its customers with a range of ancillary services, such as menu planning advice, food safety training, inventory control, product usage and labor scheduling reports. These services establish a level of trust and dependence and give Sysco valuable information relating to extensions of customer credit and accounts receivable management.

The company’s revenue growth will be driven primarily by acquisitions. Sysco’s size and free cash flow will allow it to continue to be a consolidator in a fragmented industry. Acquisitions will primarily focus on product extensions in the U.S. and geographic expansion to position Sysco to sell additional products to new and existing customers. In addition, we believe Sysco’s size, financial strength, scale and broad product offerings provide competitive advantages, particularly during times of economic uncertainty. Customers can depend on Sysco’s product reliability and timely delivery, which has allowed Sysco to gain market share from competitors.

Further industry consolidation is likely. The Federal Trade Commission blocked Sysco’s 2013 attempt to acquire its next largest competitor, US Foods. Recently, the next two largest players in size – US Foods and Performance Food – announced they are exploring a combination. Such a merger might result in regulators requiring divestments in overlapping markets.

In the most current fiscal year, the company returned approximately $2.25 billion to shareholders through dividends and share repurchases. The company has grown its dividend for 56 consecutive years while reinvesting in its core businesses.

Despite its industry dominance, Sysco faces some challenges beyond cyclical economic headwinds. The industry is highly fragmented and competitive. In addition to local and regional distributors, competition increasingly includes cash-and-carry wholesalers such as Restaurant Depot, club stores and a growing prevalence of group purchasing organizations. As an industry consolidator, there is always the risk that Sysco will overpay for acquisitions and is unable to profitably integrate these new companies.

We estimate that Sysco will be able to grow revenue long term at a mid-single digit rate. The company should be able to produce operating margins averaging in the mid-single digits, with those margins trending higher over time. Using these assumptions, our stock valuation model indicates Sysco’s current stock price offers a long-term annual average rate of return of approximately 9%.

The Goldman Sachs Group, Inc. { GS }

Drawing on over 150 years of experience, Goldman Sachs is a global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base. Clients include corporations, governments and both high- and middle-income individuals. Founded in 1869, the firm is headquartered in New York City and maintains offices in all the major financial centers around the world. Goldman converted into a bank holding company in 2008 and is regulated by the Federal Reserve.

Goldman’s brand reputation and size provides a competitive advantage for securing investment banking deals and recruiting top talent. The company’s global footprint and scale give it the capability to vie for large cross-border deals that smaller brokerages cannot manage. The firm’s nimble capital allocation is executed with an intense focus on risk management and a long-term outlook. This strategy was key to Goldman’s emergence from the financial crisis in a position of relative strength versus most competitors.

These strengths have given the bank a consistently commanding market share position. In mergers and acquisitions, Goldman currently ranks first as it has for more than 20 consecutive years.

David Solomon was appointed CEO in 2018 after serving as chief operating officer and co-head of investment banking. Since becoming CEO, he has made important changes in the management, including selecting a new chief financial officer and chief operating officer.

After an initial lackluster foray into consumer banking, which it is now deemphasizing, Goldman has pivoted its growth initiatives and capital toward its asset and wealth management business. It wants to grow its management fees and margin through scale and expand product offerings to high-net-worth clients in private equity and real estate.

The firm has a deep talent pool made possible by its partnership structure. This unique model does not rely on any one individual rainmaker. Goldman imposes equity ownership requirements on all its partners, which helps align their interests with those of common shareholders. Goldman’s leadership and legacy in its field attracts a high caliber, diversified group of talent each year.

Since the Great Recession of 2008, investment banks have faced increased regulation and higher capital requirements. In response to the new regulatory requirements, Goldman has strengthened its balance sheet by reducing debt, building capital and raising liquidity. Goldman has reallocated capital away from riskier, proprietary investments toward its more client-driven businesses such as investment banking and trading.

A criticism of Goldman is that it has been slow to respond to a decline in trading revenue and changes in the financial markets brought on by new regulatory requirements. Other banks were quicker to materially change their operations by increasing their wealth management operations and de-emphasizing trading. Being identified as a systemically important financial institution with inherent backing by the government brings increased oversight of the company’s operations and restrictions on activities. The offset is that Goldman has gained access to the Federal Reserve lending facilities, which would be especially useful should future shocks to the financial system renew liquidity concerns.

Goldman has maintained a leadership position in most of its activities and is financially stronger and less burdened by irrational competition than it was before the financial crisis. This standing will be somewhat mitigated by slower global growth, higher regulatory capital requirements and reduced leverage. We believe Goldman will be able to grow revenue in the low-single digits on market share gains and expansion in emerging markets. We expect Goldman to generate a return on equity at or over 13% during the next decade.

The Bank of New York Mellon Corporation { BK }

The Bank of New York Mellon is the world’s largest custodian bank by assets. It celebrated its 240th anniversary in 2024. It enables clients to create, trade, hold, manage, service, distribute or restructure investments. BNY Mellon has over $57.8 trillion in assets under custody and $2.1 trillion in assets under management (at third quarter 2025). The company has a vast global footprint delivering investment management and investment services in 35 countries. The global custody business is an oligopoly with six firms administering 75% of all financial assets. BNY Mellon is estimated to have approximately 20% of global market share in assets under custody.

BNY Mellon is a uniquely positioned company with a business model that is quite attractive in the banking industry. The bank provides a full spectrum of the investment process and has the ability to provide sophisticated solutions to many of the most advanced and complex financial companies and investors globally. While others offer similar services, few other firms offer the scale or breadth of products necessary to service customers in this technology-driven business at a competitive cost. BNY Mellon is deeply involved in the operations of its clients. These strong relationships result in sticky customers due to the high switching costs associated with back-office disruption that changing providers would entail. These competitive strengths have consistently delivered the highest profit margins and returns on tangible capital in the industry.

The bank tends to have the top market share in most of the servicing businesses in which it competes. Although it does face some cyclicality due to asset valuations, most revenues are recurring in nature with high switching costs. Historically, asset values have outpaced global GDP growth. We expect continued growth in cross-border investment and capital flows along with expanding international client relationships. BNY Mellon should also continue to benefit from changing regulations, driving client demand for new solutions and services while encouraging many asset managers to outsource their back-office operations for greater security and oversight.

Technology remains at the core of operations. The company’s CEO, Robin Vince, considers the firm a software-as-a-service (SaaS) company at its core. Technology will continue to grow in importance in banking, particularly the types of services provided by BNY Mellon. Last year BNY’s spending on tech exceeded $2 billion. The firm is seeing a payoff with faster execution, lower costs and faster time to market for new applications, which further strengthens client relationships. Going forward, the firm remains at the forefront in utilizing new technologies to enhance the user experience, including cloud-enabled service platforms, developing business and client analytics, faster access to data, improved search capabilities as well as expanding mobile access for clients.

BNY Mellon’s revenue is 75% fee based, which is usually stable. However, there is still some cyclicality in the business as market swings have an impact on asset values and fees. A prolonged period of ultra-low interest rates will have a negative impact on revenue due to money market fee waivers and lower profitability on lending products. In addition, the bank’s business is built on its reputation as a qualified and trustworthy manager of risks and other sensitive operations, and any harm to its reputation could negatively impact revenues for an extended period.

The bank may see lower capital requirements from the Federal Reserve (Fed), which in turn could correspond to higher returns for banks, perhaps resulting in banks electing to return excess capital to shareholders through dividends and\or share repurchases. The Fed released a new proposal in October for 2026 stress test scenarios that would lower the average stress capital buffer for U.S. banks by as much as 23 basis points.

Given the current level of assets under custody and management, we believe BNY Mellon will be able to increase revenue in the low-single digits on increased services, modest market share gains and international market expansion. We expect the custody bank can generate return on equity approaching 11% over the next decade. Based on these assumptions, our financial model indicates that at the current stock price, BNY Mellon’s stock offers a potential long-term annual return of approximately 4.2%.

December 31, 2025

Specific securities were included for illustrative purposes based upon a summary of our review during the most recent quarter. Individual portfolios will vary in their holdings over time in relation to others. Information on other individual holdings is available upon request. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Any projections are hypothetical in nature, do not reflect actual investment results and are not a guarantee of future results and are based upon certain assumptions subject to change as well as market conditions. Actual results may also vary to a material degree due to external factors beyond the scope and control of the projections and assumptions.