Municipal Bonds Might Be Worthy of Your Attention

Bonds have historically served as a boring, predictable way to derisk a portfolio and earn some steady income. As a former bond salesman, I was scarred during a dinner back in 2018 when a prospective client told me: “Nobody wants bonds. You can’t make any money with them”. Fast forward to today, and the sleepy, old bond market is alive and kicking. In the current environment, investors could be well-suited (taking into consideration their risk tolerance) to give some attention to the municipal sector of the bond market.

Municipalities have long issued bonds to fund projects ranging from new school buildings to road construction to sports stadiums and much, much more. A large portion of municipal bonds offer both federal and state tax-free interest payments, to keep funding costs lower for municipalities and incentivize investors to finance the debt. In addition to providing tax-free income, municipal bonds offer advantages like portfolio diversification, lowering the overall risk of the portfolio, and maintaining access to liquidity, if needed.

We commonly see savings accounts and bank CDs used as a means for storing excess liquidity. Bank CDs have functioned as an easy way for individual investors to pick up increased interest over standard deposits, which often pay little to no interest. Banks will typically offer an attractive fixed rate for a short time (ex. 4% for 9 months), but when that CD matures the funds will earn a much lower percentage, if not actively rolled into a new CD. Some CDs are also illiquid and possess an early withdrawal penalty if the funds need to be accessed before maturity. What if you could lock in that yield for longer, earn a spread of 3-4% over CDs, and get some tax-free income at the same time?

Exhibit 1: 10 Year Treasury Curve Over the Last 45 years. Source: Bloomberg

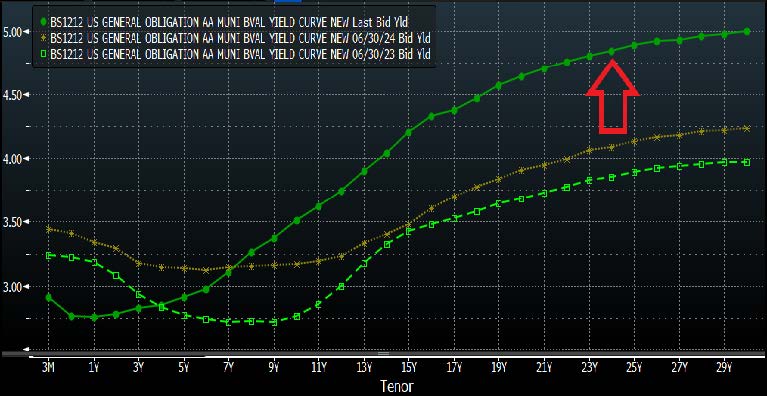

As you can see from the chart above (Exhibit 1), the 10-year treasury dating back to 1980, was in a long-term bull (as bond yields fall, prices rise) market for around 40 years. With the increase in inflation and interest rates coming out of the pandemic, that trend has reversed over the last 4 years. As treasury rates have risen, we have also seen a dramatic rise in municipal bond yields (Exhibit 2 below).

Exhibit 2: AA Rated Muni Curves from June of 2023, 2024, and 2025. Source: Bloomberg

Over the last three months, we have been buying municipals ranging in the 4 - 5% nominal yield range (before accounting for the tax impact) with many of those purchases coming at yields of 4.50% or higher. When you factor in the tax-exempt interest payment (calculated as Yield/(1-Highest Marginal Tax Rate)), those earnings begin to look fairly compelling.

Let’s look at a few examples:

• 5% yield for a TN resident (no state income tax) and in the 37% federal tax bracket: 7.93% tax-equivalent yield

• 4.50% yield for an AL resident paying 5% state income tax and in the 32% federal tax bracket: 7.14% tax-equivalent yield

• 4.25% yield for a MS resident paying 4.4% state income tax and in the 35% federal tax bracket: 7.03% tax-equivalent yield

When you begin to evaluate yields at over 7% for many investors, the benefits of diversifying and derisking the overall portfolio, and the tax-free interest payments, municipal bonds start to look more attractive and can be more widely considered for a variety of investors. We are happy to discuss how municipal bonds might work in your overall portfolio.

Disclosure: This content has been prepared by Delta Asset Management, LLC and is intended solely for informational purposes. It should not be considered personalized investment advice, nor a recommendation to buy or sell any securities. Municipal bonds involve certain risks—including market fluctuations, interest rate changes, and potential loss of principal—that may impact their value. Tax-equivalent yields are based on standard assumptions and will vary based on your specific tax circumstances. Please consult with your financial advisor or tax professional to determine whether municipal bonds align with your individual goals and financial strategy. Charts and market data referenced in this article were sourced from Bloomberg, a leading provider of financial information and analytics.