Takeaways from the Latest Banking Crisis

Retrospectively, it seems entirely predictable that the Federal Reserve’s well-telegraphed raising of interest rates after a long period of easy monetary policy would put stress on banks. Rising interest rates are like a receding tide, exposing lax oversight, ineffective regulation, mismanagement and significant asset-liability mismatches. Each of the banks that have failed this cycle has its own unique story. Whether a sin of omission or commission, once it leads to a loss of confidence on the part of depositors, banks can quickly fail. After each crisis there are important takeaways for investors, particularly how the reforms emanating from this crisis will affect the economy going forward.

The first takeaway is that reforms typically focus on the last crisis, not the one that will inevitably appear in the future. Banking reforms after the 2008 to 2009 Great Recession focused on “risk-weighted” capital to discern a bank’s health. Before the 2008 crisis, banks were holding large amounts of collateral-loan obligations and mortgage-backed securities. Congress and bank regulators wanted to ensure that banks would hold a significant percentage of risk-free or low-risk assets, such as U.S. Treasury bonds, to offset the inherent risk of a bank’s loan portfolio. However, the risk-weighted asset measure did not properly account for “duration risk,” the change in the value of a bank’s bond holdings due to a change in interest rates. As a result, even the Fed’s most severe stress test scenario in 2022 did not consider the possibility of rising interest rates.

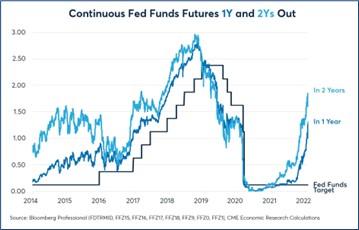

By maintaining a low-interest rate policy and continuing to inject liquidity into the economy since the 2008/2009 financial crisis, the Fed has encouraged ever greater risk-taking in search of yield. The resulting loose money supply caused the price of financial assets to go up, rates to fall to historically low levels and, ultimately, inflation to soar to levels not seen since the early 1980s. Over the last year, to stem inflation the Fed has raised the federal funds effective rate to almost 5%. Meanwhile, between 2007 and 2022, banks boosted their holdings of Treasurys and federally backed mortgage securities to 20% from 12% of total assets.. Even though U.S. government securities are considered risk-free from a default perspective, the rapid rise in interest rates led to high unrealized losses in banks’ portfolios as interest rates increased. The banks were caught in a mismatch of paying up for deposits while their bond portfolio assets were yielding lower rates. In the case of Silicon Valley Bank (SVB), the bank was forced to liquidate its long-dated Treasuries at significant losses to fund massive deposit withdrawals, thereby wiping out its equity capital and forcing its sale.

Another probable outcome of this crisis is that regional and smaller banks will come under greater oversight and regulation. The failed SVB had no chief risk officer between April 2022 and January 2023, a period in which the Fed raised rates aggressively. It is hard to fathom that vacancy would have been allowed at a “systemically important bank.” SVB during this time also committed $5 billion to a new environmental loan and investment program, comprising around 2.5% of its total assets, a significant allocation for a regional bank with no previous track record or expertise in that sector. Regulation to increase capital and strengthen compliance will come at a cost to small and midsize businesses that rely on regional and community banks. Increasing capital requirements effectively will reduce banks’ capacity to extend credit.

The spate of bank failures will also make the Fed’s job in controlling inflation more complicated. February’s economic data show that the labor market remains robust and that inflation remains well above the Fed’s 2% target. The challenge for the Fed is to dampen inflation without triggering a recession. Raising interest rates could pressure further an already weakened financial sector. Previous cycles where rates were increased are replete with pausing increases when turbulence was encountered.

In 1987, newly installed Fed Chairman Alan Greenspan raised interest rates to cool the economy. When the stock market reacted negatively, he reversed course and trimmed rates. The market reversed, and inflation climbed higher, resulting in the Fed having to tighten even more, resulting in the recession of 1990-1991. In this current episode, Chairman Jerome Powell stayed the course and raised interest rates by a quarter point on March 22, the ninth increase in a year. The Fed’s move paralleled last month’s increase in size, lifting rates to a range of 4.75% to 5% and increasing Fed funds futures one and two years out.

Sweeping deposit guarantees offered by Treasury Secretary Janet Yellen to stabilize the banking system have the potential to increase risky behavior on the part of banks. Known as “moral hazard,” bankers may not have an incentive to manage conservatively if they know their depositors will be less likely to flee due to full-stop guarantees. Likewise, depositors will be less likely to diversify their cash across multiple banks. Risk and deposits could become more concentrated at poorly managed banks. It would not be the first case where actions by the Fed or the regulators had the opposite, unintended results.

Each banking crisis brings with it reform and its attendant costs. Over time, new approaches or exceptions will surface to circumvent new regulations. Perhaps the greatest takeaway from the current crisis is how “normal” it is. When interest rates are suppressed over long periods of time and then raised, historically, it has created instability. Whatever regulatory regime is in place, it is never fool-proof, and workarounds (legal and illegal) over time will surface, setting the stage for the next cycle. Markets have survived all of this, and the free-market aspect of our economy naturally corrects for excesses both Fed-made and market-made.

March 31, 2023

Company Comments

Comments follow regarding common stocks of interest to clients with stock portfolios managed by Delta Asset Management. This commentary is not a recommendation to purchase or sell but a summary of Delta’s review during the quarter.

The Walt Disney Company { DIS }

The Walt Disney Company is a global, diversified entertainment company with operations spanning theme parks, broadcast and cable television, movie production, consumer products and new online video streaming services. The company owns some of the world’s most valuable media brands including ABC, Disney, ESPN, Lucasfilm (Star Wars), Marvel and Pixar. Disney’s broad media and entertainment breadth provides diversified distribution channels for the company’s creative content. Over the last several years, Disney has focused on three key strategic priorities: creating high-quality content for the entire family, making that content more engaging and accessible through the use of technology, and growing its brands and businesses in markets around the world.

In an abrupt move, Walt Disney’s board reinstalled Bob Iger as CEO of the firm in November 2022, with Bob Chapek stepping down immediately. Iger served as Disney’s CEO from March 2005 to February 2020 and executive chair from February 2020 to December 2021. Iger signed a two-year deal to serve as CEO to set the strategic direction for the firm and help find a successor. While Iger and the board will work together to identify the next CEO, it would not be surprising if Iger extends his stay, as he previously delayed his retirement three times in his first stint as CEO.

The COVID-19 pandemic resulting in a new stay-at-home paradigm has helped drive viewers to the Disney+ video streaming service, making it a viable player in the first year of its launch. The service was a success even before the pandemic. Streaming will benefit from the new content being created at Disney, Fox Television and film studios as well as their deep franchise libraries. Iger’s return as CEO is unlikely to alter this streaming-focused future that he helped design prior to leaving the company.

Disney has built an incredible collection of some of the world’s best media brands. The strength of its brands is solidly in place and will continue to provide Disney with opportunities to create high-quality content and experiences for years to come. The company has been very adept at using brands and creative content to generate revenue and profitability through multiple sales channels. Disney estimates that it owns five of the top six character franchises based on merchandise and consumer sales.

Over the last several years, Disney has focused on three key strategic priorities: creating high-quality content for the entire family, making that content more engaging and accessible through the use of technology, and growing its brands and businesses in markets around the world.

Sports are Disney’s major content edge. As consumer viewing options grow (internet and mobile media) and become more fragmented and as viewing preferences change, “must-see” live sports provide ESPN with an advantage over its traditional cable distributors and advertisers. ESPN profits from the highest affiliate fees per subscriber of any cable channel and generates revenue from advertisers interested in reaching adults ages 18 to 49, a key advertising demographic that watches more sports and less scripted television than other groups. These recurring, high-margin cable affiliate fees provide profit stability in most economic backdrops.

Disney’s theme parks have recovered to pre-pandemic levels in terms of attendance. In addition to the wholly owned domestic parks, Disneyland and Disney World, the company has partial ownership and management contracts to operate several international parks in France, Hong Kong, Tokyo and now China. Disney has invested heavily in the past few years, adding new attractions, new resorts and new cruise ships as well as park expansions and upgrades. Disney theme parks are one-of-a-kind destinations that have competition, but nothing with the scale, magnitude, uniqueness or relevance for the entire family of the Disney experience.

Disney does face long-term challenges. The cost of sports programming rights continues to rise sharply, and ESPN pays handsomely to acquire major sports contracts. ESPN has been able to defray some of these costs by charging ever-increasing affiliate fees to cable operators. With such high fees, angst is growing among viewers, cable operators and program competitors.

If ESPN cannot continue to pass along sports rights costs to cable operators, its profit margins will erode; however, profit erosion would be gradual due to ESPN’s long-term contracts with both major sports leagues and cable operators. The high value of sports has also created additional competition for ESPN. All major broadcasters, such as FOX and NBC, and the major sports leagues themselves have increased their investments in sports programming. More competition for viewers is likely to drive up the overall operating costs to broadcast sporting events over time.

Disney under former CEO Chapek’s tenure was embroiled in a highly visible controversy with the Florida state government resulting in the loss of Disney’s special tax status for its Florida theme parks. Iger indicated during a town hall meeting with employees in December that the company would take a lower profile on contemporary social issues and focus on trimming content costs for streaming and enhancing shareholder returns. Based on these and other steps, activist investors have withdrawn their advocacy for Board representation and endorsed management’s recent initiatives.

Disney’s proven ability to develop entertainment icons with increased consumer opportunities from merchandising royalties, positive cable pricing, theme park expansion as well as new film and TV online streaming services should allow the company to continue its good revenue growth with solid operating profit margins. Our valuation model suggests that the company’s stock is priced to generate a long-term average annual rate of return of approximately 15%.

Enbridge Inc. { ENB }

With the successful merger with Spectra Energy Corp in 2017, Canadian company Enbridge is now North America’s largest energy infrastructure company with strategic pipelines transporting crude oil, natural gas and liquids. Enbridge’s Mainline system moves two-thirds of all crude oil exports from Canada and approximately 25% of North American crude oil. Canada’s oil sands supply is landlocked and separated from most of its refining markets by long distances and relies on pipelines for transport. Western Canada production is projected to exceed pipeline capacity, making the company’s Mainline system and its access to various North American refining markets more valuable. In gas transmission, Enbridge owns more than 30,000 miles of natural gas transmission pipelines and transports approximately 20% of all-natural gas consumed in the U.S.

The company’s assets are well positioned in the North American pipeline industry that possesses burdensome regulatory requirements, elusive right-of-way easements, lengthy development cycles and significant funding requirements – all of which raise high barriers for anyone outside incumbent operators to construct additional pipeline capacity. Moreover, Enbridge has a number of high-quality investment opportunities with the capacity to invest $6 billion a year to further growth.

In 2022, the company acquired Tri-Global Energy, which had a strong track record of success in developing and integrating renewable energy projects in North America.

Generally, Enbridge will not pursue expansion opportunities without securing contracted capacity. The company is insulated from direct commodity price exposure as approximately 95% of cash flow is underpinned by long-term (10 to 20 years), fee-based contracts. However, the cyclical supply and demand nature of commodities and related pricing can have an indirect impact on the business as shippers may continue to accelerate or delay certain projects.

In addition to pipelines, the company operates a diverse energy portfolio as a distributor and operator of alternative energy. Enbridge is Canada’s second-largest wind and solar power generator. Beginning with its first investment in a wind farm in 2002, Enbridge committed $5.4 billion toward wind, solar, geothermal, power transmission and a host of other emerging technology projects. The segment accounts for a small but growing contribution to the company’s consolidated earnings. In 2022, the company acquired Tri-Global Energy, which had a strong track record of success in developing and integrating renewable energy projects in North America.

Due to its size and profile, Enbridge has many challenges with its capital projects from environmental concerns. Permitting and regulatory delays could hinder the timeline of some projects. Enbridge’s Line 3 pipeline extension went through several elements of regulatory approval and delays, which created cost overruns and reduced return on invested capital.

Regulated assets are subject to economic and political regulation risk – that means regulators and other government entities may change or reject proposed or existing projects including permits and regulatory approvals for new projects. Enbridge’s long-term proposition hinges on the ability to secure additional growth projects that drive earnings and dividend growth.

With Enbridge positioned to benefit from growing oil sands supply with its Mainline system and increasing demand for natural gas, the company is positioned to generate significant free cash flow, allowing the company to grow its dividends and fund pipeline expansions and investments toward renewable energy. Based on these assumptions, our valuation model indicates a long-term average annual return of approximately 9.5%.

Baxter International, Inc. { BAX }

Baxter International provides a broad portfolio of essential renal and hospital products, including acute and chronic dialysis, IV solution and administrative sets, infusion systems and devices, nutrition therapies, biosurgery products and inhaled anesthetics as well as pharmacy compounding, drug formulations, and digitally equipped medical beds, software and service technologies.

The company’s global footprint as well as the critical nature of its products and services play a key role in expanding access to healthcare in emerging markets and developed countries. Baxter is among the global market share leaders in all its businesses with manufacturing in 20 countries and products and systems sold in 100 countries. The company’s manufacturing scale, worldwide distribution and product breadth in injectable and inhaled therapies make the firm an important supplier to caregivers.

The company’s manufacturing scale with worldwide distribution and product breadth in injectable and inhaled therapies make the firm an important supplier to caregivers.

Baxter’s medical delivery and dialysis businesses are comprised of a diversified mix of both basic and innovative products. The company maintains large global market shares in mature but stable products, such as IV-administered therapies, infusion systems and nutritional solutions. Baxter offers the broadest selection of pre-mixed drugs in the industry and continues to expand revenue from innovative drugs, such as inhaled anesthesia. Baxter’s renal division – its largest business – should continue to benefit from good dialysis market growth due to rising global rates of diabetes. The consumable and medically necessary nature of Baxter’s products provides relatively consistent revenue and operating cash flow.

Baxter has initiated two major operational changes to its organization. First, the company has created a strategy centered around portfolio optimization, operational excellence and strategic capital allocation. The company’s plan to continue to drive sales growth and profit margin improvement includes a focus on several high-margin businesses (Acute Renal Therapy, Biosurgery, Inhaled Anesthesia and Nutrition). It also includes the launch of new, high-margin products and services as well as exiting certain low-margin businesses. The company will also continue to reduce its manufacturing footprint and capture additional supply chain efficiencies. In addition, Baxter is spinning out its renal care and acute therapies divisions into a separate, publicly traded company to better help drive growth by having a more targeted focus on investment and capital allocation.

Baxter faces a number of challenges, including debt reduction. In 2021, Baxter purchased Hillrom, a company that makes digitally equipped hospital beds and operating room equipment. There is potential revenue synergy in that Baxter’s products already sell in hospital and clinical settings. Baxter’s salesforce should be an advantage for Hillrom’s products to expand further into international markets, which represent 59% of Baxter’s sales but only 32% of Hillrom’s. However, in making the acquisition Baxter increased its balance sheet leverage which will need to be reduced.

Baxter’s main challenges are increasing competition in its more commoditized offerings and continuing efforts on cost containment in the healthcare industry in general that may exert pricing pressure on medical products. In addition to government regulation, managed care organizations’ purchasing power has strengthened due to their consolidation into fewer, larger organizations with a growing number of enrolled patients. Quality control is also a risk factor. Product recalls can harm relationship trust. Baxter also faces regulatory risk. Many of its products are subject to approval by the FDA and regulatory agencies in other countries.

We believe Baxter can generate long-term revenue growth in the 3% range with cash flow margins approaching 20%. Based on these assumptions, our valuation model indicates Baxter’s current stock price offers a long-term average annualized rate of return of approximately 10.5%.

Becton, Dickinson and Company { BDX }

Becton is one of the leading medical device companies supplying a diversified mix of basic and sophisticated products throughout the world. In recent years, the company has made two transformative acquisitions: CareFusion Corporation in 2015 and C. R. Bard, Inc. in 2017. The benefits of the acquisitions have been larger than expected. The company has extracted cost synergies while maintaining the culture and expanding the portfolio of products. The acquisitions helped transform the company from a commoditized medical supply and devices manufacturer into a healthcare solutions company that improves healthcare processes and efficiencies.

The majority of Becton’s sales are in what are called “sharps,” which consist of safety needles, ultra-thin pen needles, hypodermic needles, syringes, catheters and related equipment. The company maintains the largest market share of sharps worldwide based on the quality of its products, innovation, worldwide service capability and lower cost. Expansion opportunities remain in foreign markets due to slower adoption of safety guidelines and the need to minimize the spread of infectious diseases in developing countries. The essential and recurring nature of Becton’s medical products allows the company some relative stability in revenues despite the tougher medical technology spending environment. We expect this business will continue to generate strong free cash flow, which management has historically deployed wisely.

Legacy CareFusion is a global leader in medication management and delivery and in patient safety solutions. CareFusion focuses on medication management, infection prevention, operating room and procedural effectiveness and respiratory care with a large installed base of equipment and high switching costs. CareFusion maintains the No. 1 market position in many of its product categories, especially in infusion pumps and medication dispensing equipment, where it is estimated to hold 25% and 70% global share, respectively.

The C. R. Bard segment has a leading product portfolio in the area of vascular, urology, oncology and surgical specialties. The products include bioresorbable grafts, vascular stents, vascular grafts, angioplasty balloon catheters and IV filters. Bard is strong in urology and has a suite of new solutions to help streamline medication management.

The essential and recurring nature of Becton’s medical products allows the company some relative stability in revenues despite the tougher medical technology spending environment.

Becton’s other businesses are more technology-oriented and also have large market shares. The primary products are diagnostic testing instruments for disease detection and cellular analysis instruments for pharmaceutical and biotech research. Both product categories have related equipment and supplies businesses that are sizeable. Diagnostics are the most likely growth drivers for Becton. The growth in infectious diseases will drive demand for rapid diagnosis and guided therapy. Cost pressures and lab technician shortages are driving demand for automation, while increased access to healthcare in emerging markets is driving the need for both automation and disease screening.

Hospital buying groups are consolidating to increase their purchasing power with suppliers. Longer term, the major risk to Becton is the commoditization of sharps, which Becton continues to combat through innovation, such as safety-engineered devices and ultra-thin pen needles. In addition, Becton faces growing competition from medical product manufacturers with sizeable research budgets, particularly in fast-growing segments. In healthcare, there is always the risk that competitors create more innovative products that disrupt the industry by replacing existing products.

We feel confident assuming higher growth in Becton’s more innovative businesses, such as diagnostics and drug dispensing technologies and more modest growth in its maturing needle business. The population of the world is growing, and in major industrialized nations the population is aging, which implies medical equipment will be in strong demand. Based on these assumptions, our stock valuation model indicates Becton’s current stock price offers a long-term average annual rate of return of approximately 9%.

Dated: March 31, 2023

Specific securities were included for illustrative purposes based upon a summary of our review during the most recent quarter. Individual portfolios will vary in their holdings over time in relation to others. Information on other individual holdings is available upon request. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Any projections are hypothetical in nature, do not reflect actual investment results and are not a guarantee of future results and are based upon certain assumptions subject to change as well as market conditions. Actual results may also vary to a material degree due to external factors beyond the scope and control of the projections and assumptions.