Q3 2025 Quarterly Newsletter

The current U.S. equity market as of mid-September 2025 has been characterized as expensive relative to the historical norm with the S&P 500 trading at 23.7x forward earnings. The 30-year average is around 17x forward earnings. On the surface, valuations seem immune from the geopolitical instability from two wars, uncertainty over tariffs and a spending bill that adds to an already gargantuan federal debt.

Economic growth through the first half of this year has been sluggish. Data on employment indicate that job growth has slowed markedly with the job data from the September 5 report underscoring a deteriorating picture with the unemployment rate drifting up to 4.3%.

In response to these signals, on September 18 the Federal Reserve cut interest rates by a quarter percentage point to a range of 4.0% to 4.25% with an indication of more to come. Given recent tepid job reports, the Fed has now pivoted to prioritizing job growth in place of tamping down inflation. The Fed’s dilemma, of course, is that just because it is now focused on employment does not mean that inflation is no longer a threat.

The Federal Reserve’s preferred inflation gauge is the Personal Consumption Expenditures (PCE) index. It provides a broader picture of actual consumer spending by encompassing a wider range of goods and services and adjusts for changes in consumer behavior, such as when consumers substitute cheaper goods when prices rise. The PCE is estimated to be 2.9% compared with 2.7% a year ago, with tariffs possibly contributing to the rise.

It is important to note that the valuation of individual stocks and the market as a whole often reflect a forward view of earnings as opposed to historical or current conditions. With that in mind, one phenomenon to note this year is that U.S. companies are repurchasing their shares at a record pace. Birinyi Associates (a provider of stock market analysis), has tracked buybacks since 1982 and is projecting U.S. companies will repurchase more than $1.1 trillion worth of their own stock this year, an all-time record. This forecast could mean managements are expressing confidence in the long-term outlook for their companies and the economy.

Another factor indicating that market valuations may be reflecting the future is the impact of artificial intelligence (AI). Even companies that are not directly involved in the development of AI will possibly see gains from its application. Goldman Sachs predicts AI will grow global gross domestic product (GDP) by $7.0 trillion in over 10 years.

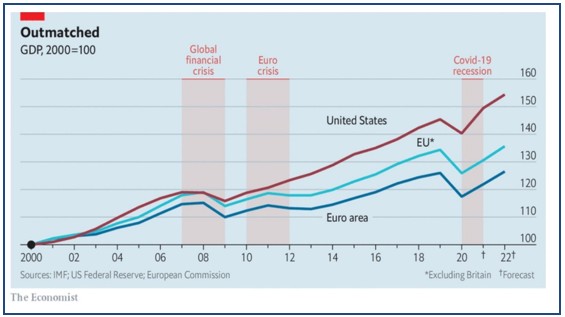

Also buttressing valuations is the amount of foreign capital that continues to flow into U.S. equity markets. In the second quarter, it was estimated to be around $400 billion. Other economies have lagged behind the U.S. in terms of productivity and consumer spending. The U.S. economy has grown faster than that of the European Union (EU) since 2008. The EU has generally trailed the U.S. in terms of growth with the EU’s GDP at 67% of the U.S. GDP in 2023 versus 110% in 2008.

Equity markets are sometimes perceived as expensive and susceptible to short-term dislocation. However, over the long term, U.S. equities have historically outperformed other asset classes. This success is driven by several factors: new waves of technology, attributes of a more flexible, transparent and efficient U.S. economy, favorable comparisons to foreign markets, and consistent reinvestment through capital spending, research and development, and stock repurchases.

Company Comments

Comments follow regarding common stocks of interest to clients with stock portfolios managed by Delta Asset Management. This commentary is not a recommendation to purchase or sell but a summary of Delta’s review during the quarter.

Nestlé { NSRGY }

Wells Fargo is one of the largest community-based, diversified financial services companies in the U.S., with nearly $2.0 trillion in assets. The bank offers a full range of consumer banking, commercial banking and investment banking services. Wells Fargo has 218,000 employees and 11,000 financial advisors. Founded in 1852 and headquartered in San Francisco, it is consistently one of the top deposit gatherers in the U.S. The Wells Fargo model delivers a vast product set through approximately 4,500 branches.

Wells Fargo is largely a conventional lender. The bank’s more than $1.3 trillion deposit base and near dominant market position in fast growing markets are its biggest advantages. Wells has consistently paid less for balance sheet funding than most of its competitors over the last decade. It is also able to generate more revenue per dollar of assets than most peers. This low-cost funding has continued through the bank’s recent regulatory challenges to its reputation. Account closures did not spike during the worst of the sales problems, underscoring customers’ willingness to stick with the bank.

The company has a leading position in the national mortgage market. The firm benefits from economies of scale in both origination and servicing, as it also leverages an advanced technology platform. An additional strength is the company’s diversified income stream, which benefits from the more stable revenue generated by its retail brokerage, advisory and asset management businesses. Unlike its major competitors, Wells is not a major player in the cyclical investment banking and capital markets businesses.

On June 4, 2025, the Federal Reserve removed the $2.0 trillion asset cap that had been in place since 2018. This asset cap was due to the compliance failures in retail banking. Its removal will allow the bank to reposition capital for deposit growth and new growth initiatives. In addition, the remaining seven of thirteen regulatory orders were removed. This shift is an important step in improving the growth prospects of Wells and will allow it once again to grow deposits.

Although regulatory oversight in recent years has been burdensome, it has led to meaningful improvements in Wells Fargo’s governance. The company has taken several important steps, including separating the roles of Board Chairman and CEO, amending its bylaws to require an independent Chair, and electing new independent directors with expertise in risk management, cybersecurity, and consumer and social responsibility. Additionally, Wells Fargo created a Board committee dedicated to overseeing compliance.

We feel the bank has rectified many of its issues and undertaken multiple steps to restore customer trust. The bank hired Charles Scharf, former head of Bank of New York Mellon, almost six years ago to help improve its reputation and get businesses back on track. He has prioritized resolving outstanding regulatory issues, changed the bank’s reporting structure, hired many new managers and committed to cost cutting to the tune of approximately $10 billion in annual expenditures.

The bank has initiated several expense savings programs to get its efficiency ratio back under 60%. A bank’s efficiency ratio is a key performance metric used to assess a bank’s profitability. It is calculated by dividing a bank’s operating expenses by its total income. The lower the ratio the more efficient the bank is in generating income.

Wells boasts strong market share positions in many of the largest, fastest-growing and wealthiest markets in the country, which should help the bank grow organically faster than the banking industry on average once regulatory issues are resolved. In addition, Wells Fargo’s balance sheet strength has allowed it to gain market share from banks needing to reduce assets and raise liquidity. Over time we believe the bank’s net interest margin will expand as interest rates rise and the lending environment stabilizes.

We anticipate the company’s efficiency ratio will improve over the intermediate term as it benefits from declining regulatory burdens, cost-cutting measures, a somewhat smaller branch network and annual non-interest income growth. We have assumed Wells will continue to maintain excess capital and liquidity above the required norm. Based on our assumptions, our financial model indicates that at the present stock price Wells Fargo’s stock offers a potential long-term annual return of 5.0%.

NOV Inc. { NOV }

NOV designs, manufactures and sells oil rig equipment and a range of products used to extract oil and gas. The company offers a wide spectrum of products and components for both land-based and offshore drilling rigs. It operates in 65 countries across six continents. Approximately 55% of the company’s revenue is derived from operations outside the U.S. Its broad product offering has positioned it to adjust its focus from exploration rigs to servicing production wells as the energy transition from fossil fuels accelerates.

NOV has a number of competitive and cost advantages that smaller competitors are unlikely to achieve. The firm’s product portfolio is one of the broadest in the oil service industry – ranging from complete systems for drilling rigs, pressure pumping units and blowout preventers to wireline trucks and equipment. NOV has a product for nearly every aspect related to drilling and generally has the first or second market share position in every product line it sells. Importantly, its scale and low capital-intensive manufacturing processes enable it to generate strong, free cash flow annually. The firm’s large installed base of equipment combined with the reach of its global repair and maintenance facilities provide a good base of recurring revenue from aftermarket services.

NOV’s business depends on activity levels in the oil and gas industry. The demand for its services depends on the number of oil rigs in operation, the number of oil and gas wells being drilled and the depth and condition of those wells, production volumes and well completions. NOV is exposed to the deep-water market at a time when many energy producers are favoring shorter-cycle projects and are facing pricing pressures due to an oversupply of deep-water rigs.

Overcapacity has also reduced the demand for NOV’s original equipment manufactured spare parts. Drillers have taken to purchasing surplus and retired rigs at auction at historically low prices and stripped them for parts. This move bypasses the company’s aftermarket parts. It will take some time to dissipate this supply and demand imbalance.

NOV has avoided large-scale acquisitions and targeted small, technology-oriented companies. The company’s intent is to expand newly acquired technologies across its global footprint, while at the same time continuing to roll out new, internally developed technological advancements in its equipment. Over the coming years, aging rig fleets must be upgraded and replaced with more modern equipment to cost effectively drill new sources of oil and gas. NOV’s vast global installed base uniquely positions it to continue to grow through its current advancements, such as automated drilling systems and real-time remote monitoring of equipment with analytics-driven predictive maintenance.

A bright spot has been the small but growing opportunity set in the renewables sector, where NOV is leveraging its core expertise in lifting and handling and in rig architecture to serve the offshore wind industry. The dollar value of these jacking systems and wind turbine installation vessels is roughly equivalent to that of a full equipment package for a jack-up oil rig. NOV has been making investments in the wind energy space for nearly 20 years and now sees growing opportunities as a large number of additional wind vessels will be needed over the coming years.

In 2025, the company generated excess cash flow relative to its designated capital allocations and declared a special dividend of $0.21 per share in addition to its annual dividend of $0.30 per share.

We believe that NOV’s rig and production segments will produce steady growth as the world increasingly seeks oil production from offshore and unconventional reservoirs. We expect the company’s asset-light manufacturing processes and continued efficiency improvements will result in low-teens cash flow margins. Based on our assumptions, our financial model indicates that at the current stock price, NOV’s stock offers a potential long-term annual return of approximately 9.5%.

Otis Worldwide Corporation { OTIS }

Otis is the world’s largest elevator and escalator manufacturing, installation and service company. The company installs and services a wide range of passenger and freight elevators as well as escalators and moving walkways for residential and commercial buildings and infrastructure projects. As the largest original equipment manufacturer (OEM), Otis has installed 3.5 million elevators globally. Of these, it services 2.4 million of its own brand as well as equipment manufactured by its competitors. Otis is truly a global company with over 70% of its revenues generated outside the U.S. The company operates through a global network of 1,400 branches and offices in more than 70 countries.

Otis’ main competitive advantages are its global manufacturing scale and large installed base of elevators, which provide a cost advantage. Its market share and scale have been built over many decades of reliability, dependability and know-how, which are critically important to developers.

Otis’ large installed base generates high margin, recurring revenue streams from repair and maintenance services and end-of-life cycle replacements, which in turn provide good future revenue visibility. High margin services and aftermarkets now make up nearly 62% of total company revenue and 87% of total company profitability for 2024.

Elevator installation and service are mature globally. As a result, long-term industry growth expectations are modest; however, Otis does have advantages and investment opportunities to help drive growth, potentially above that of the industry. The global elevator fleet is aging. In Europe, where Otis dominates, over three million units are over 20 years old, which is typically when elevators need to be upgraded. As these elevators need upgrades, Otis’ 94% service contract retention rate should help drive future revenue growth and maintain industry leading profit margins. In addition, Otis has increased investments in technology to leverage data and digitalization to gain market share and improve productivity. Otis’ growth in digitally connected services could increase group margins over time due to more efficient technician routes, higher retention rates and premium service rates.

One of the main operating risks for the company is to maintain pricing and retention rates in China, which are much lower than those in mature markets. Competition in China is intense regarding price. Although Otis tries to focus on the higher end portion of the Chinese market, which is more stable, overall conditions remain challenging. A decline in new construction from a higher interest rate environment has slowed new orders. Globally, the trend toward remote workers could result in more limited elevator use with less need for maintenance and repair.

Given its large market share and industry maturity, we believe Otis can grow revenue in the low single digits annually over the next decade. At this pace, given rational competition and Otis’ expanding high margin services portfolio and operating efficiencies, we believe cash flow margins can average approximately 16% during this period. Based on these assumptions, our stock valuation model indicates Otis’ current price offers a long-term average annual rate of return of nearly 8.0%.

Accenture PLC { ACN }

Accenture is one of the largest information technology (IT) providers in the world, providing solutions for specific enterprise problems as well as strategy and advertising consultancy. The company has a broad top-tier client base, integrating and developing software for 80% of the largest global 500 companies. Of Accenture’s top 100 clients, all have been with them for 10 years or more. Accenture achieves sought after scale and servicing by employing nearly 800,000 people throughout 120 countries. Customer relationships and multi-industry expertise set Accenture apart from its peers. The company has approximately 300 clients contributing more than $100 million in annual revenue.

Many of Accenture’s clients are in the early stages of their digital transformations and recognize that technology is central to their business. The firm provides large systems integration for companies such as SAP, Oracle, Salesforce, Microsoft and Workday. Its engineers customize the software to the client’s needs, building capabilities, connecting databases or adding extra analytics. Accenture’s personnel are often embedded throughout a client’s business. In developing expertise across a wide spectrum, Accenture can develop best industry practices and apply solutions throughout its client base.

Outsourcing is another side of Accenture’s business. It focuses on repeatable business processes, such as data centers, accounting, procurement and application services. After a software integration project, clients can choose to have Accenture manage and maintain software and systems in various departments. These contracts span several years, and there is significant investment by the client making it difficult for Accenture to be displaced.

The company is continually adapting new technology and services to remain relevant and engaged with its most important customers. Accenture consistently invests over $1.0 billion annually in research and development and has over 8,300 patents and pending patent applications. At the same time, the company invested $6.6 billion across 46 acquisitions to gain additional skills and talent in high-growth areas of the market. Accenture most recently announced a three-year, $3.0 billion investment in generative artificial intelligence (AI) to help clients across all industries achieve greater growth and efficiency. This investment has generated strong demand, with $4.5 billion in new AI bookings to date. These investments will continue to allow the company to provide cutting edge solutions in AI, blockchain, quantum computing, cybersecurity and more. Accenture is well-positioned to take advantage of accelerated consulting and outsourcing demand driven by the digitization of the global economy.

The IT service industry, including Accenture, is subject to the overall cyclicality of enterprise IT spending, which has been weaker of late as many companies have faced a tougher business environment. Recently, the U.S. federal government has put many federal consulting contracts under closer review. Longer-term growth of AI agents could shift enterprise spending in certain low-end areas away from outsourcing firms such as Accenture. However, we do not currently view AI as a major threat to Accenture as it operates predominantly high-end projects and services. Further, as a top service provider, we believe Accenture will play an important role in helping corporate clients to best utilize AI agents, which should help drive additional growth for the company.

Based on the financial characteristics we have outlined, we assume that Accenture can grow its revenue at an annual average rate of approximately 4.0% organically over the next decade. At this pace of growth and given improved efficiency, we believe operating margins can average 15.5% during the period. Accordingly, our stock valuation model indicates a long-term annual rate of return of over 10%.

September 30, 2025

Specific securities were included for illustrative purposes based upon a summary of our review during the most recent quarter. Individual portfolios will vary in their holdings over time in relation to others. Information on other individual holdings is available upon request. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Any projections are hypothetical in nature, do not reflect actual investment results and are not a guarantee of future results and are based upon certain assumptions subject to change as well as market conditions. Actual results may also vary to a material degree due to external factors beyond the scope and control of the projections and assumptions.