The Price We Pay

What gives us the confidence to stay invested in individual stocks when markets fluctuate and economic news is uncertain? It is the concept of intrinsic value, which we periodically have referred to in previous quarterly letters. As part of Delta’s investment discipline, we calculate the intrinsic value of every stock that comprises our model portfolio. It is a complex but valuable calculation that paints a fundamental long-term picture of the businesses in which we have chosen to invest.

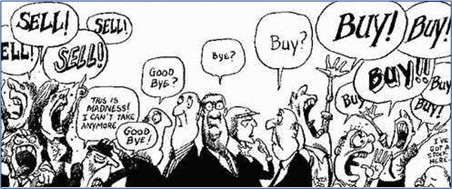

There is a difference between price and value. When you buy a stock, the market price is what you pay for it, and the intrinsic value is what you receive. The price you pay for a stock can depend on or be influenced by a variety of factors, including the emotions of the markets and macro-economic events as well as political and competitor news. Psychology in place of fundamentals can hold sway in the short term. Prices fluctuate instantaneously as data is released and interpreted. In contrast, intrinsic value excludes the daily volatility and price fluctuations by looking at a company’s future projected cash flows to its shareholders. It is a far more stable long-term concept than market value.

What precisely is the definition of intrinsic value as it relates to stocks? It is the present value of cash flows to shareholders discounted at an appropriate interest rate to compensate for risk. The calculation requires the input of some significant assumptions, such as the rate of growth of revenues, profit percentages, taxes, use and cost of debt and the ability of the company to successfully reinvest a portion of its earnings. The result is a subjective assessment of the company’s prospects grounded in its fundamentals – that is why it is called fundamental analysis. It is an appraisal of the value the company has the potential to deliver over time.

What is the utility of intrinsic value in the investment process? We use intrinsic value to calculate our expected rate of return on an investment and to look for arbitrage opportunities between the current price and value in buy and sell decisions. When we add a new company to our model portfolio, we look to take advantage of a mispriced asset trading below its long-term value. Purchasing at a discount creates a margin of safety as a way to further reduce risk. Finally, calculating intrinsic value gives us the conviction and discipline to hold on to our investments when markets swing from euphoria to gloom, insulating us from the “emotions of the market.”

Intrinsic value changes over time as a company’s fundamentals respond to competitors, innovation, the macro-economic environment, etc. Within an 18-month cycle, we reconstruct each model from scratch to verify that our original investment thesis is intact. Our key challenge is to determine if a company can sustain its performance at a level that justifies retaining it in the portfolio. Obviously, there is no way to estimate a company’s future cash flows with absolute certainty. If a business is, in our opinion, overly complex or subject to constant change and disruption, we tend to exclude it from consideration.

We use intrinsic value to calculate our expected rate of return on an investment and to look for arbitrage opportunities between the current price and value in buy and sell decisions.

Occasionally there are periods when it is more difficult to find strong, well-managed companies with an intrinsic value higher than their share price. We are in one of those periods today. However, the market will always provide periodic windows to purchase shares, such as during the COVID-19 pandemic in early 2020 or the financial crisis of 2009. When those opportunities arrive, it is important to have an established process and tools. There will be undervalued stocks as long as there are human investors in stock markets – and that is why intrinsic value is so useful.

September 30, 2021

COMPANY COMMENTS

Comments follow regarding common stocks of interest to clients with stock portfolios managed by Delta Asset Management. This commentary is not a recommendation to purchase or sell but a summary of Delta’s review during the quarter.

Lowe’s Companies, Inc. { LOW }

Lowe’s is a leading home improvement retailer in North America with just over 2,000 stores in the U.S. and Canada. The company’s stores offer a wide selection of home improvement products and services aimed at do-it-yourself and professional customers as well as commercial business clients.

Lowe’s has proven to be an effective retail operator with a culture built on exceptional customer service. Over many years, the company has developed a highly automated distribution system that links its suppliers, distribution centers and company stores to a single network, driving operating efficiency. Lowe’s significant scale combined with its efficient distribution system creates a cost advantage. The company uses this cost advantage for maintaining low prices to generate higher sales volumes while producing solid free cash flow.

The U.S. home improvement retail market is mature and has become fully saturated with stores. After years of rapid expansion, Lowe’s new store growth will slow as quality locations become increasingly limited. To help drive incremental growth and improve profit margins, the company is redoubling efforts to improve in-store execution and operating efficiency. Lowe’s is adding customer-facing employees, improving inventory management and significantly shrinking its operating cost structure. The company also plans to increase its proprietary products and further penetrate the professional market. While Lowe’s and The Home Depot, Inc. together control approximately 40% of industry market share, the retail home improvement industry remains fragmented. Lowe’s competitive strengths and new products and services should drive further market share gains from smaller competitors.

Lowe’s significant scale combined with its efficient distribution system creates a cost advantage. The company uses this cost advantage for maintaining low prices to generate higher sales volumes while producing

solid free cash flow.

While there are some signs of competitive pricing between Lowe’s and Home Depot, it is one of the more rational areas of retailing. This accord is in part due to less pressure from online web retailers like Amazon. The project nature of the purchases at the home centers have enabled them to maintain pricing better than other areas of retailing. Lowe’s own e-commerce sales continue to grow rapidly and now account for approximately 10% of total company sales. The company has completed a redesign of its website in addition to rolling out a new point of sale system in its stores in 2020. The company has also committed to major investments over the next five years to open new distribution centers and modernize its supply chain with digital technology.

A focus of growth for Lowe’s is the professional customer, who makes up about 30% of Lowe’s revenues. The professional customer business has grown faster on average than do-it-yourself business. Lowe’s is ramping up its inventory geared to professionals and providing more tailored services. “Lowe’s for Pros” was launched in 2015 to make it easier for professionals to manage products at multiple jobs as well as purchase and pick up items nationwide. Lowe’s also offers a compelling 5% back credit program for professionals. Pro customers can now go online to create custom catalogs for recurring purchases and access purchase history reports.

Lowe’s named Marvin Ellison as President and CEO effective July 2018. He was the Chairman and CEO of JCPenny and has previous experience as an executive with Home Depot. His goal is to reduce the performance gap with Home Depot while enhancing Lowe’s supply chain and product offerings.

Given minimal expected store expansion, we have assumed Lowe’s can grow revenues low single digits over the next decade. At this pace of growth and given improving in-store execution, we believe average cash flow margins will gradually improve to just over 13% over this period. Based on these assumptions, our stock valuation model indicates Lowe’s current stock price offers a long-term average annual rate of return of approximately 6%.

The Goldman Sachs Group, Inc. { GS }

Drawing on 150 years of experience, Goldman Sachs provides global investment banking, securities and investment management and financial services to a substantial and diversified client base. Clients include corporations, governments and both high- and middle-income individuals. The company manages its businesses and reports results across four segments: Investment Banking, Institutional Client Services, Investing and Lending, and Investment Management. Founded in 1869, the firm is headquartered in New York and maintains offices in all the major financial centers around the world. Goldman converted to a bank holding company in 2008 and is regulated by the Federal Reserve System.

Goldman’s brand reputation and size provides a competitive advantage for securing investment banking deals and recruiting top talent. The company’s global footprint and scale give it the capability to vie for large cross-border deals that smaller brokerages cannot handle. The firm’s nimble capital allocation is executed with an intense focus on risk management and a long-term outlook. This strategy was key to Goldman’s emergence from the financial crisis in a position of relative strength versus most of its competitors. .

Goldman imposes equity ownership requirements on all of its partners, which helps align their interests with those of common shareholders.

David Solomon was appointed CEO in 2018 after serving as chief operating officer and co-head of investment banking. Since becoming CEO, he has already made important changes in management, including selecting a new chief financial officer and chief operating officer. The company held its first ever investor day on January 29, 2021, and in considerable detail laid out its three-to-five-year financial plan.

The new strategy entails broadening the customer base to include a younger, millennial demographic while lowering the cost of funding by seeking deposits. The bank will expand its commercial and consumer banking segment through consumer loans, credit cards and deposits. Efficiency should come with greater automation and e-banking. A central part of this strategy is developing a more global and diverse workforce while increasing staffing in financial engineering and operations.

An example of the new strategy is the firm’s online de novo bank named Marcus by Goldman Sachs, launched in 2016 and designed to appeal to tech savvy consumers. Since its launch, Marcus has grown to more than four million clients. The firm expects to double that deposit base over the next three to five years. Goldman recently co-launched a credit card with Apple. The company has goals of $20 billion+ in credit card loans and balances and $125 billion+ in consumer deposits by 2024.

The firm has a deep talent pool made possible by its partnership structure. This unique model does not rely upon any one individual rainmaker. Goldman imposes equity ownership requirements on all of its partners, which helps align their interests with those of common shareholders. Goldman’s leadership and legacy in its industry attracts a high caliber, diversified group of talent each year.

Since the Great Recession of 2008, investment banks have faced increased regulation and higher capital requirements. In response to the new regulatory requirements, Goldman has strengthened its balance sheet by reducing debt, building capital and raising liquidity. The increased capital will aid management in navigating the current COVID-19 pandemic and related market volatility. Goldman also has reallocated capital away from riskier, proprietary investments toward its more client-driven businesses, such as investment banking and trading.

Being identified as a systemically important financial institution with inherent backing by the government brings increased oversight of the company’s operations and restrictions on activities. The offset is that Goldman has gained access to Federal Reserve lending facilities, which would be especially useful should future shocks to the financial system renew liquidity concerns.

Goldman has maintained a leadership position in most of its businesses and is financially stronger and less burdened by irrational competition than it was before the financial crisis. This will be somewhat mitigated by slower global growth, higher regulatory capital requirements and reduced leverage. We believe Goldman will be able to grow revenue in the low single digits on market share gains and expansion in emerging markets. We expect Goldman can generate return on equity approaching 10% over the next decade. Based on these assumptions, our financial model indicates that at the current stock price Goldman Sachs’ stock offers a potential long-term annual return of approximately 5%.

L’Oréal S.A { LRLCY }

L’Oréal, established in 1909, is a leading manufacturer in the global cosmetics market with a presence in 150 countries on five continents. The company has excellent market share positions in most regions of the globe. The scale and breadth of L’Oréal’s brand portfolio and geographic reach give it sustainable competitive advantages. Its success over many years is attributable to the development of premium products, global branding and a number of product innovations geared to targeted regions.

The company has developed apps such as ModiFace, to allow customers to virtually apply cosmetics with facial and skin analysis and product suggestions. Customers are spending more time online trying different cosmetics than doing so in the store.

Much of L’Oréal’s recent growth has been organic. A key driver of growth has been innovative products coupled with an impressive amount spent on advertising and promotion (30% of sales versus 25% on average for the sector). By marshalling its resources on a limited number of brands, the company can launch new products using the identity of an established brand. A healthy investment in research and development has also contributed to growth. The company invests over 3% of sales on research and development (R&D). With 21 research centers around the world, the company’s research is focused on “universalizing beauty.” “Universalizing beauty” means adapting it to local tastes and culture and making it accessible to all. As a result of its robust R&D budget, the company filed 500 patents in 2020.

L’Oréal is considered an advanced digital player in e-commerce, achieving 34% of sales online in 2020. The company has developed apps, such as ModiFace, to allow customers to virtually apply cosmetics with facial and skin analysis and products suggestions. Customers are spending more time online trying different cosmetics than doing so in the store.

L’Oréal’s emerging markets will remain a key growth driver going forward, and “beauty” as a category is well-positioned to benefit from growing consumer spending in many of these regions. Europe and North American markets are mature with high penetration and well-established competitors. In contrast, the company is seeing growth in newer markets where the middle class is growing and eager for high quality makeup and skincare products. L’Oréal is targeting to more than double its customer base from 1.2 billion to 2.5 billion over the next 10 to 15 years by focusing on product categories, which are popular in emerging markets.

Asia remains a major area of growth in emerging markets and now represents over 27% of sales. It is L’Oréal’s second largest market globally. Asia currently accounts for nearly 40% of total global cosmetics spending and 55% of total global skincare spending. L’Oréal is now the number one cosmetics player in China, with leading positions in makeup, skincare and colorings. It only recently launched its hair care products there, which comprise 25% of the Chinese market. With these new category introductions, L’Oréal should continue to gain market share in this important region.

The company maintains worldwide pricing for its products; as a result, profit margins in emerging economies are comparable to those produced in developed ones. A sustainable competitive advantage is the company’s ability to cover all price points with a range of brands. L’Oréal can establish a presence in an emerging economy by introducing lower price point brands without damaging the later introduction of its higher priced premium brands.

We believe L’Oréal can continue to grow its revenues mid-single digits due to the growth potential in Asia and other emerging markets despite its exposure to mature North American and European markets. Profit margins are likely to remain high, driven by cost efficiency measures in marketing and supply sourcing as L’Oréal consolidates the operational aspects of its disparate businesses. We believe L’Oréal will be able to maintain long-term operating profit margins in the low 20% range with return on invested capital of approximately 25%.

NOV Inc. { NOV }

NOV (formerly National Oilwell Varco, Inc.) designs, manufactures and sells oil rig equipment and a range of products used to extract oil and gas. The company offers a wide spectrum of products and components for both land-based and offshore drilling rigs. The firm operates in 65 countries across six continents. Approximately 55% of the company’s revenue is derived from operations outside the U.S.

NOV has a number of competitive and cost advantages that smaller competitors are unlikely to achieve. The firm’s product portfolio is one of the broadest in the oil service industry – ranging from complete systems for drilling rigs, pressure pumping units and blowout preventers to wireline trucks and equipment. NOV has a product for nearly every aspect related to drilling and generally has the first or second market share position in every product line it sells. Importantly, NOV’s scale and low capital intensive manufacturing processes enable the company to generate strong free cash flow annually. The firm’s large installed base of equipment combined with the reach of its global repair and maintenance facilities provide a good base of recurring revenue from aftermarket services.

NOV’s business depends on activity levels in the oil and gas industry, which has been down since the fall from peak oil prices in 2014. The demand for its services depends on the number of oil rigs in operation, the number of oil and gas wells being drilled, the depth and condition of those wells, production volumes and well completions. NOV is exposed to the deep-water market at a time when many energy producers are favoring shorter-cycle projects and are facing pricing pressures due to an oversupply of deep-water rigs. In the case of NOV, lower oil prices have constrained oil producers’ capital spending, which has translated into fewer wells drilled and lower rig orders. Additionally, U.S. production has been reduced, hurting short-term equipment and parts demand. More recently, lower production and strong demand recovery has helped rebalance oil supply and demand, leading to higher oil prices.

NOV’s vast global installed base uniquely positions the company to continue to grow through its current advance-ments, such as automated drilling systems and real-time remote monitoring of equipment with analytics-driven predictive maintenance.

During the oil down-turn – including the significant industry disruption from COVID-19 shut-downs – the company has focused on operational efficiency, cost control, service quality and the rollout of new technology, which should allow it to play a key role in defining the next upcycle. NOV has avoided large scale acquisitions but targeted small, technology-oriented acquisitions. The company should expand newly acquired technologies across its global footprint, while at the same time continuing to roll out new, internally developed technological advancements in its equipment. Over the coming years, aging rig fleets must be upgraded and replaced with more modern equipment to cost effectively drill new sources of oil and gas. NOV’s vast global installed base uniquely positions the company to continue to grow through its current advancements, such as automated drilling systems and real-time remote monitoring of equipment with analytics-driven predictive maintenance.

A bright spot has been the small but growing opportunity set in the renewables sector, where NOV is leveraging its core expertise in lifting and handling and in naval architecture to serve the offshore wind industry. These jacking systems and wind turbine installation vessels have a roughly equivalent dollar value to a full equipment package associated with a jackup oil rig. NOV has been making investments in the wind energy space for nearly 20 years and now has a $400 million business line with growing opportunities as a large number of additional wind vessels will be needed over the coming years.

We believe that NOV’s rig and production segments will produce steady growth as the world increasingly seeks oil production from offshore and unconventional reservoirs. We expect the company’s asset-light manufacturing processes and continued efficiency improvements will result in low-teens cash flow margins. Based on our assumptions, our financial model indicates that at the current stock price, NOV’s stock offers a potential long-term annual return of approximately 12%.