Parallel Tracks of Inflation

The U.S is entering the third year of the pandemic with a still mutating virus and a rapidly expanding economy. One aftershock of the pandemic – inflation – is eclipsing other issues and indeed has been the subject of several of our recent quarterly letters. The pandemic made it more difficult to produce goods and transport them to their destinations. Governments shored up incomes, and households flush with cash were eager to spend. Due to a combination of caution and lockdowns, much of this spending went to consumer goods in place of services and entertainment creating shortages and putting pressure on prices.

Central banks and governments’ reaction to the new Omicron variant could be significantly different than to previous waves. In place of loosening monetary policy to prop up economies, many central bankers are weighing heightened inflation as more of a threat than any short-term supply chain disruptions. Milder surges of the pandemic are having a less negative impact on spending and job creation than earlier phases when demand initially dropped more than supply. This consequence leaves demand intact – while adding to supply chain disruptions and shortages – thereby sustaining inflationary pressures.

It is during these times that the investment process is of heightened importance.

On a parallel track, the other culprit of rising prices is an extraordinarily aggressive monetary policy, known as quantitative easing. Between December 2019 and August 2021, the U.S. money supply grew by $5.5 trillion, a phenomenal 35.7% increase. Milton Friedman, an economist who specialized in monetary economics, was quoted as saying, “Inflation is always and everywhere a monetary phenomenon.” Supply shortages can affect the pricing of individual goods but will have little effect on the overall price level if monetary growth is stable. Increasing the money supply, however, without an offset in productivity or savings can increase the overall price level.

The Labor Department released the November Producer Price Index, which rose 9.6% from a year earlier, the highest growth since 2010. These numbers suggest that there is a further runway for consumer inflation, which hit a near four decade high of 6.8% in October. In response to this heightened inflation, on December 15, 2021, the Federal Reserve approved plans to scale back its pandemic stimulus support more quickly.

The current environment has certainly been challenging for companies to navigate, particularly the pent-up demand for products and raw materials, in light of tight transport capacity and delays on just about every freight mode. It is during these times that the investment process is of heightened importance. We focus on companies that exhibit pricing power, have scale to achieve efficiencies and improve productivity, and are directed by competent management teams who can quickly adapt to changing circumstances. A couple of examples illustrate the point on how companies can navigate supply chain challenges and inflation.

When the pandemic first hit, lead times from some of Walmart Inc.’s suppliers were up more than 200% globally. In 2020, the company experienced stockouts in several grocery and general merchandise categories. In response, the company began chartering its own ships to circumnavigate reduced shipping capacity, rerouting products to less congested ports, and extending work schedules to overnight hours to help unload cargo. Walmart also made wage investments and started seasonal hiring earlier to ease its labor shortages.

Lowe's Companies, Inc., made significant investments in its supply chain network over the last 18 months, including opening more than 13 different distribution centers across the U.S. in markets such as Chicago, IL, Columbus, OH, Orlando, FL, and Riverside CA. In addition, over the next 18 months the company will open 50 cross-dock terminals, seven bulk distribution centers and four e-commerce fulfillment centers. These investments should allow the company to improve inventory in stores and next day shipment for e-commerce customers. As with other pro-active retailers, Lowe’s has been bringing seasonal inventory into its stores and warehouses earlier than planned due to longer shipping lead times.

The Procter & Gamble Company is well positioned to combat the headwinds of inflation as demonstrated by its track record of 65 years of consecutive growth and an impressive 131-year dividend history. The company’s global presence in both manufacturing and distribution as well as diversified product lineups gives it advantages in meeting supply chain and cost pressures. P&G’s market share leading products have given it the flexibility to raise prices in 9 of 10 product categories. Continuous product innovation has allowed it to deliver incremental value as opposed to just raw price increases. Examples include New Tide and Ariel formulations which provide more cleaning power at lower temperatures, the new Oral B electric toothbrush that delivers greater plaque removal and plastic-free Gillette razor packaging, among many others.

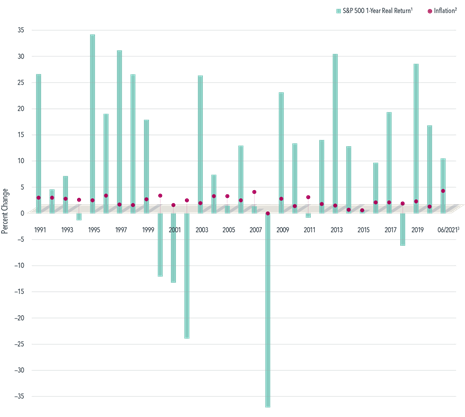

Finding companies that adapt to rapidly changing economic conditions, technology and consumer tastes is an attribute of active investing. Equities, when appropriately selected, have historically offered superior returns to inflation. As indicated in the chart below, annual S&P 500 returns have posted an average annualized return of 8.5% after adjusting for inflation. Even going all the way back to 1926, the annualized inflation-adjusted return on stocks was 7.3%. Obviously, past performance is not a guarantee of future performance, but it illustrates the flexibility and success of businesses in generating efficiencies and passing on cost increases during bouts of inflation.

Annual inflation-adjusted returns of S&P 500 Index vs. inflation, 1991–2021

1 Real returns illustrate the effect of inflation on an investment return and are calculated using the following method: [(1 + nominal return of index over time period) / (1 + inflation rate)] − 1. S&P data © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

2 Based on non-seasonally adjusted 12-month percentage change in Consumer Price Index for All Urban Consumers (CPI-U). Source: US Bureau of Labor Statistics.

3 Year-to-date return for 2021 through June 30.

December 21, 2021

COMPANY COMMENTS

Comments follow regarding common stocks of interest to clients with stock portfolios managed by Delta Asset Management. This commentary is not a recommendation to purchase or sell but a summary of Delta’s review during the quarter.

Accenture { ACN }

Accenture is one of the largest information technology (IT) providers in the world, providing solutions for specific enterprise problems as well as strategy and advertising consultancy. The company has a broad top tier client base, integrating and developing software for 80% of the largest global 500 companies. Of Accenture’s top 100 clients, 98 have been with them for 10 years or more. Accenture achieves sought-after scale and servicing by employing over 600,000 people throughout 200 cities in 51 countries.

Many of Accenture’s clients are in the early stages of their digital transformations and recognize that technology is central to their businesses. The firm provides large systems integration for companies such as Microsoft Corporation, Oracle Corporation, Salesforce, SAP SE and Workday, Inc. Its engineers customize the software to each client’s needs by building capabilities, connecting databases or adding extra analytics. Accenture’s personnel are often embedded throughout a client’s business. In developing expertise across a wide spectrum, Accenture can develop best industry practices and apply solutions throughout its client base.

The company has a broad top tier client base, integrating and developing software for 80% of the largest global 500 companies. Of Accenture’s top 100 clients, 98 have been with them for 10 years or more.

Outsourcing is another side of Accenture’s business. It focuses on repeatable business processes, such as data centers, accounting, procurement, and application services. After a software integration project, clients can choose to have Accenture manage and maintain software and systems in various departments. These contracts span several years, and there is significant investment by the client which makes it difficult for Accenture to be displaced.

The company is continually adapting new technology and services to remain relevant and engaged with its most important customers. In 2021, Accenture invested $1.1 billion in research and development and had over 8,200 patents and pending patent applications. At the same time, the company invested $4.2 billion across 46 acquisitions to gain additional skills and talent in high-growth areas of the market. These investments have allowed the company to provide cutting edge solutions in artificial intelligence, blockchain, extended reality, quantum computing, cybersecurity and more. Accenture is well positioned to take advantage of accelerated consulting and outsourcing demand driven by the digitization of the global economy. As a result of internal investment and acquisitions, revenues related to digitization, cloud computing and security have tripled over time and now make up approximately 70% of company revenues.

Like most consulting firms, Accenture is dependent on a high utilization of its employee base. Increasing automation in some of Accenture’s processes may result in lower utilization rates if the company fails to predict its personnel needs. People with high technical skills ultimately drive the business, and employee wage inflation is an emerging concern due to high demand and the shortage of available talent in some geographies.

Based on the financial characteristics we have outlined, we anticipate that Accenture can grow its revenue at an annual average rate of approximately 6% over the next decade. At this pace of growth and given improved efficiency, we believe cash flow margins can average 11% during the period. Accordingly, our stock valuation model indicates a long-term annual rate of return of approximately 4%.

Eaton Corporation plc { ETN }

Eaton, formed in 1911 as a manufacturer of truck axels, has transformed its portfolio through a stream of acquisitions in the past two decades. Eaton is a diversified global industrial company that manufactures components, systems and services that manage electrical and mechanical power. Eaton is a virtual pure play on the industrial economy, primarily selling and providing services to original equipment manufacturers (OEMs). The company offers energy-efficient products and services in a wide variety of markets including agriculture, data centers, military contracting, manufacturing, aviation, commercial and residential construction and healthcare. Eaton continues to position its systems and services toward less cyclical, faster growing, higher margin end markets.

Eaton is one of the leading global providers of electrical components and systems for power quality, distribution and control. After the acquisition of Cooper Industries in 2012, Eaton’s Electrical Group now accounts for 60% of total revenues. Though its electrical businesses have a slower growth profile versus its industrial businesses, long term we believe the electrical equipment market has good growth opportunities due to the need for power capacity, regulatory changes driving energy efficiency and power quality and safety. In addition, Eaton should benefit from the growing demand to control power and mechanical systems remotely for electrical grids, factories and data centers. Management is also driving stronger through-the-cycle profitability and free cash flow through product line optimization, multi-year productivity plans and raising the overall level of operational excellence.

Eaton should benefit from the growing demand to control power and mechanical systems remotely for electrical grids, factories and data centers.

Through the years, Eaton has either innovated or acquired many forms of power management and distribution, focusing on highly engineered motors, drives and hydraulic systems used in various industrial end markets. The company’s industrial aerospace and vehicle businesses, which make up 25% of total company revenue, are market leaders with competitive advantages, including its manufacturing scale, cost advantages and high customer switching costs. These businesses have vast installed bases that grow primarily through innovation. Eaton’s installed bases require significant customer capital investment, which leads to good recurring aftermarket revenue streams. Eaton’s after-market services also serve to protect long-term customer relationships.

Eaton, along with its industrial peers, is facing some near-term operating headwinds. The global capital spending environment is being weighed down by uncertainty due to COVID-19 and to heightened geopolitical risks. Some of Eaton’s domestic and international end markets are tied to aerospace, vehicle and various commodities. If a downturn in these end markets deepens, earnings will be negatively impacted and reduce the company’s return on invested capital. We believe these challenges are primarily short-term. Management’s current strategy, focused on structural cost reduction throughout the organization, should continue to lead to higher long-term operating profitability as these end markets recover.

We believe the company’s leadership position, extensive installed base, recurring after-market service revenues and long-term customer relationships should provide support for long-term growth and higher profitability. This combination led to the company returning $2.8 billion to shareholders in the form of dividends and share repurchases last year. Dividends totaled $1.2 billion, and share repurchases totaled $1.6 billion, representing 4% of shares outstanding. Going forward, we expect Eaton will grow revenues low single digits on average with cash flow margins of 21% over our 10-year modeling period. Based on these assumptions, our stock valuation model indicates Eaton’s current stock price offers an average annual long-term rate of return of approximately 5%.

Intel Corporation { INTC }

Intel is the world’s largest semiconductor chipmaker by revenue. The company supplies the computing industry with the chips, boards, systems and software that are the primary components of computer architecture. Intel is the leading designer and manufacturer of microprocessors for the global personal computer (PC) and data center markets. Intel pioneered the x86 architecture for microprocessors used in most PCs and data centers today. The company currently operates in two main business groups: the more mature Client Computing Group and the Data-centric Group, which includes the more advanced and faster growing computing segments such as Internet of Things (IoT), Artificial Intelligence (AI), automotive and 5G networks.

After decades of leadership in the design and manufacture of complex chips, Intel has developed important advantages including manufacturing scale, broad product scope and intangible assets related to its advanced intellectual property. This scaling advantage is defended by higher than peer research and development (R&D) and capital spending that enable the company to deliver a more predictable cadence of products that move, store and process data at lower cost. Intel’s cost advantage is critical in a capital-intensive industry where large-scale manufacturing facilities, or foundries, cost $20 billion or more to build, which creates significant barriers to entry.

Intel has a dominant position in the mature PC space, which has modest growth expectations, but the company continues to invest to advance the business and maintain market share in this high margin segment. Gaming computers and consoles, both of which rely on x86 processors for speed and reliability, continue to be a growth driver for Intel. We expect Intel to continue to benefit from the growth in cloud computing, which requires huge data center build-outs, increasing chip demand. This digitalization of everything from the technology sectors to businesses such as industrials, health care, finance and communications among others creates data that has to be stored, analyzed and transmitted. In addition, Intel’s more mature businesses generate the significant free cash flow needed to invest in faster growing areas such as IoT, AI and 5G that are still in the early innings of their development.

After decades of leadership in the design and manufacture of complex chips, Intel has developed important advantages including manufacturing scale, broad product scope and intangible assets related to its advanced intellectual property.

Maintaining a consistent pace of technological advancements in chips is critical to Intel’s continued success. After recent setbacks, Intel hired Pat Gelsinger, a tech veteran and former CEO of VMware, Inc., as its new CEO. Prior to VMware, Mr. Gelsinger was a 30-year veteran of Intel and was the company’s first Chief Technology Officer who led 14 different microprocessor programs. An engineer with deep knowledge of the semiconductor space, he has laid out a roadmap to generate a faster development of chip advancements and to surpass its chip rivals in advanced chip processes. Beyond chip advancements, Intel has launched Intel Foundry Services to manufacture chips for designers such as Amazon Web Services, Inc., Advanced Micro Devices, Inc. (AMD) and Qualcomm Technologies, Inc. This new revenue stream will take years to fully develop, but it will increase Intel’s chip capacity in a time of growing chip demand as society becomes more and more digital.

Several risks and challenges lie ahead for Intel, including typical cyclicality of the chip space, increased competition and manufacturing setbacks. Competition is Intel’s primary long-term challenge. Intel has a dominant share in PCs and x86-based servers, but recent delays in process upgrades have allowed its competitors to gain some of its market share. In addition, some customers have begun to design their own chips to diversify their supply chain and to have more control over major supply inputs. We believe the consolidated nature of the industry, limited chip manufacturing capacity globally and the years it takes to bring on new capacity make shifts in market share slow.

Based on the financial characteristics we have outlined, we expect that Intel can average low single-digit revenue growth over the next decade. At this pace of growth and given improved process efficiency along with the competition outlined above, we believe operating margins can average nearly 30% during the period. Accordingly, our stock valuation model indicates a long-term annual rate of return of approximately 12%.

Carrier Global Corporation { CARR }

Carrier is a leading provider of heating, ventilation, and air conditioning (HVAC), refrigeration, fire, and security solutions. The company’s products promote smarter, safer and more sustainable buildings and infrastructure and help to effectively preserve the freshness, quality and safety of perishables across a variety of industries. Carrier began operating as an independent company as part of a spin-off from United Technologies Corporation (UT) in 2020. The company is led by David Gitlin who previously served as CEO of UT’s Collins Aerospace unit. Carrier has an extensive global footprint with approximately 53,000 employees, including 3,600 engineers. Its products and services are sold in over 160 countries worldwide.

The primary strength of Carrier is found in its HVAC segment, which provides heating and air products, controls and solutions. The company is advantaged with strong brands, leading positions and scale. The company is a top player within both residential and commercial unitary systems. Carrier has built its leading positions through a record of innovation, which continues today. Since 2014, it has grown its number of engineers by 20% to 3,600 and holds approximately 7,000 patents. Much of this innovation is driven toward long-term growth drivers, such as increasing climate regulations and digitalization of products toward automation and predictive maintenance. Carrier has released 200 new products during the past two years. Carrier is also focused on best environmental practices, and it has reduced waste use by 43% and its carbon footprint by 44% from 2006.

The company’s broad range of product and service offerings, its industry-leading brands, and its reputation for quality and innovation make it a trusted provider for critical applications in industries such as construction, transportation, security, food retail, and pharmaceutical. Carrier is focusing investments toward developing smart, sustainable and efficient solutions for, according to the company, mega-trends of urbanization, climate change, increasing requirements for food safety driven by the food needs of our growing global population, rising standards of living and increasing energy and environmental regulations.

Since 2014, it has grown its number of engineers by 20% to 3,600 and holds approximately 7,000 patents. Much of this innovation is driven toward long-term growth drivers, such as increasing climate regulations and digitalization of products toward automation and predictive maintenance.

The company recently launched its Carrier 600 Plan. This operating initiative is expected to result in substantial cost savings from supply chain improvements, better factory efficiency driven by automation and lower general and administrative expenses by increasing shared services. The plan is expected to generate $600 million in annual cost savings by year’s end 2022. These cost savings will be used for new product innovation, provide improved operating margins and free cash flow, resulting in a strengthened balance sheet over time.

A slowdown in commercial construction and new housing starts is a cyclical risk facing Carrier and the industry. The company’s strong market position has typically led to a strong recovery after a downturn in building activity. In addition, the evolving COVID-19 pandemic could have a dampening effect on many of the company’s products. Though typically rational, competition will be an ongoing challenge. Carrier faces reputable competitors that continue to invest to improve their own product lines.

We believe Carrier can grow revenue in the low-single digits annually over the next decade. At this pace of growth, in addition to its Carrier 600 operating efficiency plan, we believe cash flow margins will gradually improve to 16% plus, over time. Based on these assumptions, our stock valuation model indicates Carrier’s current price offers a long-term average annual rate of return of approximately 6%.

Otis Worldwide Corporation { OTIS }

Otis is the world’s largest elevator and escalator manufacturing, installation and service company. The company installs and services a wide range of passenger and freight elevators as well as escalators and moving walkways for residential and commercial buildings and infrastructure projects. As the largest original equipment manufacturer (OEM), Otis has installed 3.5 million elevators globally. Of these, it services 1.5 million of its own brand and 500,000 of its competitors. Otis is truly a global company with over 70% of its revenues generated outside of the U.S. The company operates through a global network of 69,000 employees, including sales reps, field technicians and engineers.

Otis’ main competitive advantages are its global manufacturing scale and large installed base of elevators, which provide a cost benefit. Its market share and scale have been built over many decades of reliability, dependability and know-how, which are critically important to developers. Otis’ large installed base generates high margins, recurring revenue streams from repair and maintenance services and end of life cycle replacements, which in turn provides good future revenue visibility. High margin services and aftermarket now make up nearly 60% of total company revenue and 80% of total company profitability.

Elevator installation and service are globally mature. As a result, long-term industry growth expectations are modest; however, Otis does have advantages and investment opportunities to help drive growth, potentially above that of the industry. The global elevator fleet is aging. In Europe, where Otis dominates, over three million units are over 20 years old, which is typically when elevators need to be upgraded. As these elevators need upgrades, Otis’ 93% service contract retention rate should help drive future revenue growth and maintain industry leading profit margins. In addition, Otis has increased investments in technology to leverage data and digitalization to gain market share and improve productivity. Otis’ growth in digitally connected services could increase group margins over time due to more efficient technician routes, higher retention rates and premium service rates.

Otis’ large installed base generates high margins, recurring revenue streams from repair and maintenance services and end of life cycle replacements, which in turn provides good future revenue visibility.

Otis’ largest risk and challenge is China. One of the main operating risks for the company is to maintain pricing and retention rates in China, which are much lower than those in mature markets. Competition in China is intense regarding price. Although Otis tries to focus on the higher-end portion of the Chinese market, which is more stable, overall conditions remain challenging. A slowdown in construction or continued volatility from COVID-19 responses globally is a near-term threat. The potential permanent increase in remote workers could result in more limited elevator use with less need for maintenance and repair.

Given its large market share and industry maturity, we believe Otis can grow revenue in low-single digits annually over the next decade. At this pace, given rational competition and Otis’ expanding high margin services portfolio and operating efficiencies, we believe cash flow margin can average approximately 16% during this period. Based on these assumptions, our stock valuation model indicates Otis’ current price offers a long-term average annual rate of return of nearly 7%.