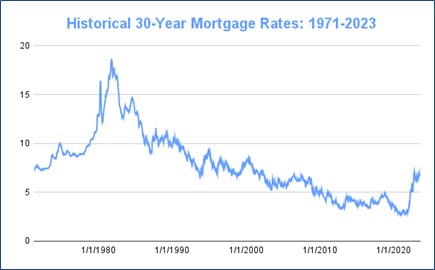

The Bond Market's Return to Normalcy?

Headlines and economic pundits assert that interest rates are high and are negatively impacting the economy. Keeping things in perspective can be challenging when mortgage rates have nearly tripled in the last two years and the 10-year Treasury is at a 16-year high. Are the pundits justified in declaring interest rates high?

It depends upon the specific time period over which today’s rates are being compared. Freddie Mac, the quasi-governmental backer of conventional mortgage loans, has tracked average mortgage rates since April 1971. In reality, interest rates are getting back to what used to be normal. From a longer-term perspective, rates are approaching the average. From 1971 to now, historical mortgage rates have jumped above 18% and have dipped below 3%. Over that period, mortgage rates for 30-year loans have averaged 8%. The current 30-year fixed mortgage is averaging 8.04%. The same applies for 10-year Treasuries. The current 10-year Treasury bond yields 4.72%, below the 5.88% 10-year average.

The chart represents weekly averages for a 30-year fixed-rate mortgage.

Average for 1971-2023 as of September 6, 2023. Source: Freddie Mac PMMS.

© TheMortgageReports.com

The reason some investors perceive rates to be high is that the recent rise followed an extended period of super depressed rates. Thanks to the Federal Reserve, the U.S. experienced a decade-plus of near zero (federal funds) interest rates that followed the 2008-2009 crisis and were suppressed again during the COVID-19 pandemic. These low rates incented a lot of bad behavior as companies piled on debt, governments borrowed heavily, and capital was allocated to poor investments such as the recent special-purpose acquisition company (SPAC) – or “blank check” company – phenomenon.

We are conditioned to think that higher rates are bad for the economy. It is true that at a certain point elevated rates can discourage investment and constrain the housing market. But higher rates can also incentivize a more rational allocation of capital, encourage greater financial discipline on personal and business balance sheets and increase opportunities for investors who are seeking returns on capital commensurate with risk.

From 1971 to now, historical mortgage rates have jumped above 18% and have dipped below 3%. Over that period, mortgage rates for 30-year loans have averaged 8%.

As we have stated in a previous Perspective, the relationship between stock prices and interest rates is a complicated one. Higher rates can increase volatility in stock and bond prices and cause sector rotations. Conversely, studies also have shown that higher real rates of interest – the rate the investor receives after allowing for inflation – and stock market multiples tend to move together. Recent data have shown that the economy is in decent shape with low unemployment, continued job growth and strong consumer demand.

Today, the problem with higher rates is that they merge with other threats to the economy. Industrial strikes, climbing gas prices, persistent inflation, political risk of a government shutdown and a looming presidential election, any of which could potentially disrupt an underlying healthy economy.

Given the large capital needs of the federal government, we may be in for a higher interest rate environment for the foreseeable future. A lot of foreign buyers are scaling back their Treasury purchases. This may cause rates to remain at these levels or rise further in order to attract sufficient buyers to absorb all of the upcoming Treasury issues. At Delta, our focus is on finding companies that are positioned for the long-term, have sustainable business models and reflect stable, conservative capital structures, regardless of the level of interest rates.

Delta Team Highlight: Brandon Byrd CFP®

Company Comments

Comments follow regarding common stocks of interest to clients with stock portfolios managed by Delta Asset Management. This commentary is not a recommendation to purchase or sell but a summary of Delta’s review during the quarter.

Lowe’s Companies Inc. { LOW }

Lowe’s is a leading home-improvement retailer in North America with just over 1,700 stores in the U.S. In February 2023, Lowe’s completed the sale of its Canadian retail business, which operated 232 stores in Canada. The company’s current stores offer a wide selection of home improvement products and services aimed at do-it-yourself and professional customers as well as commercial business clients.

Lowe’s has proven to be an effective retail operator with a culture built on exceptional customer service. Over many years, the company has developed a highly automated distribution system that links its suppliers, distribution centers and company stores to a single network, driving operating efficiency. Lowe’s significant scale combined with its efficient distribution system creates a cost advantage. The company uses this cost advantage for maintaining low prices to generate higher sales volumes, while producing solid free cash flow.

Since 2018, these new initiatives have borne fruit. As a result of the company’s successful focus on the pro customer, omnichannel capabilities and improvement in product assortment, the company grew adjusted operating margin to 13% in 2022 – which is more than a 440-basis point improvement from 2018.

The U.S. home improvement retail market is mature and has become fully saturated with stores. After years of rapid expansion, Lowe’s new store growth will slow as quality locations become increasingly limited. To help drive incremental growth and improve profit margins, the company is redoubling efforts to improve in-store execution and operating efficiency. Lowe’s is adding customer-facing employees, improving inventory management and significantly shrinking its operating cost structure. The company also plans to increase its proprietary products and further penetrate the professional market. While Lowe’s and Home Depot together control approximately 40% of the industry market share, the retail home-improvement industry remains fragmented.

Since 2018, these new initiatives have borne fruit. As a result of the company’s successful focus on the pro customer, omnichannel capabilities and improvement in product assortment, the company grew adjusted operating margin to 13% in 2022 – which is more than a 440-basis point improvement from 2018.

While there are some signs of competitive pricing between Lowe’s and Home Depot, it is one of the more rational areas of retailing. This rarity is in part due to less pressure from online web retailers like Amazon. The project nature of the purchases at the home centers has enabled them to maintain pricing better than other areas of retailing. Lowe’s own e-commerce sales continue to grow rapidly and now account for approximately 10% of total company sales. The company has completed a redesign of its website as well as rolled out a new point of sale system in its stores in 2020. The company also has committed to major investments over the next five years to open new distribution centers and modernize its supply chain with digital technology.

A focus of growth for Lowe’s is the professional customer, who makes up about 30% of Lowe’s revenue. The professional customer business has grown faster on average than do-it-yourself business. Lowe’s is ramping up its inventory geared to professionals and providing more tailored services. “Lowe’s 4 Pros” was launched in 2015 to make it easier for professionals to manage products at multiple jobs and purchase and pick up items nationwide. Lowe’s has a compelling 5% back credit program for professionals. Pro customers now can go online to create custom catalogs for recurring purchases and access purchase history reports. By the fourth quarter of 2022, the company had delivered 11 consecutive quarters of double-digit Pro comparable sales growth in the U.S.

Lowe’s named Marvin Ellison as President and CEO effective July 2018. He was the Chairman and CEO of J.C. Penney and has previous experience as an executive with Home Depot. His goal has been to reduce the performance gap with Home Depot and enhance Lowe’s supply chain and product offerings.

Given the limited expected store expansion, we have assumed Lowe’s can grow revenues low single digits over the next decade. At this pace of growth and given improving in-store execution, we believe average cash flow margins will gradually improve to just over 13% over this period. Based on these assumptions, our stock valuation model indicates Lowe’s current stock price offers a long-term average annual rate of return of approximately 10%.

L’Oréal S.A. { LRLCY }

L’Oréal, established in 1909, is a leading manufacturer in the global cosmetics market with a presence in 150 countries on five continents. The company has excellent market share positions in most regions of the globe. The scale and breadth of L’Oréal’s brand portfolio and its geographic reach gives it sustainable competitive advantages. The company’s success over many years is attributable to the development of premium products, global branding and a number of product innovations geared to targeted regions.

Much of L’Oréal’s recent growth has been organic. A key driver of growth has been innovative products coupled with an impressive amount spent on advertising and promotion, specifically 30% of sales versus 25% on average for the sector. By marshalling its resources on a limited number of brands, the company can launch new products using the identity of an established brand. A healthy investment in research and development has also contributed to growth. The company invests over 3% of sales in research and development (R&D). With 21 research centers around the world, the company’s research is focused on “universalizing beauty.” “Universalizing beauty” means adapting products to local tastes and culture and making that depiction accessible to all. As a result of its robust R&D budget, the company filed 560 patents in 2022.

L’Oréal is considered an advanced digital player in e-commerce, achieving 30% of sales online in 2022. The company has developed apps such as ModiFace to allow customers to virtually apply cosmetics with facial and skin analysis and products suggestions. Customers are spending more time online trying different cosmetics than in-store experiences. L’Oréal’s mid-term goal is to achieve 50% of sales from online sources. L’Oréal’s emerging markets will remain a key growth driver going forward, and “beauty” as a category is well positioned to benefit from growing consumer spending in many of these regions. European and North American markets are mature with high penetration and well-established competitors. In contrast, the company is seeing growth in newer markets where the middle class is growing and eager for high quality make-up and skincare products. L’Oréal is targeting to more than double its customer base from 1.2 billion to 2.5 billion over the next 10 to 15 years by focusing on product categories, which are popular in emerging markets.

L’Oréal is considered an advanced digital player in e-commerce, achieving 30% of sales online in 2022.

Asia remains a major area of growth in emerging markets and now represents over 27% of sales, making it L’Oréal’s second largest market globally. Asia currently accounts for nearly 40% of total global cosmetics spending and 55% of total global skincare spending. L’Oréal is now the number one cosmetics player in China, with leading positions in skin care, make-up and coloring. It only recently launched its hair care products, which comprise 25% of the Chinese market. With these new category introductions, L’Oréal should continue to gain market share in this important region.

The company maintains worldwide pricing for its products so profit margins in emerging economies are comparable to those produced in developed ones. Another advantage is the company’s ability to cover all price points with a range of brands. L’Oréal can establish a presence in emerging economies by introducing lower price point brands without damaging the later introduction of its higher priced premium brands.

We believe L’Oréal can continue to grow its revenues mid-single digits due to the growth potential in Asia and other emerging markets despite its exposure to mature European and North American markets. Profit margins are likely to remain high driven by cost efficiency measures in marketing and supply sourcing as L’Oréal consolidates the operational aspects of its disparate businesses. We believe L’Oréal will be able to maintain long-term operating profit margins in the low 20% range with a return on invested capital over 20%.

NOV Inc. { NOV }

NOV Inc. designs, manufactures and sells oil rig equipment and a range of products used to extract oil and gas. The company offers a wide spectrum of products and components for both land-based and offshore drilling rigs. The firm operates in 65 countries across six continents. Approximately 55% of the company’s revenue is derived from operations outside the U.S. The company’s broad product offering has positioned it to adjust its focus from exploration rigs to servicing production wells as the energy transition from fossil fuels accelerates.

NOV has a number of competitive and cost advantages that smaller competitors are unlikely to achieve. The firm’s product portfolio is one of the broadest in the oil service industry – ranging from complete systems for drilling rigs, pressure pumping units, and blowout preventers to wireline trucks and equipment. NOV has a product for nearly every aspect related to drilling and generally has the first or second market share position in every product line it sells. Importantly, NOV’s scale and low capital-intensive manufacturing processes enable the company to generate free cash flow annually. The firm’s large installed base of equipment combined with the reach of its global repair and maintenance facilities provide a good base of recurring revenue from aftermarket services.

NOV’s business hinges on activity levels in the oil and gas industry. The demand for its services depends on the number of oil rigs in operation, the number of oil and gas wells being drilled as well as the depth and condition of those wells, production volumes and well completions. NOV is exposed to the deep-water market at a time when many energy producers are favoring shorter-cycle projects and are facing pricing pressures due to an oversupply of deep-water rigs.

More recently, NOV has experienced a renewal of demand over the last several quarters driven by a global recovery in drilling activity post-COVID and favorable oil and gas prices. The North American rig count has recovered to pre-pandemic levels though international drilling activity still lags 2019 levels.

NOV has avoided large-scale acquisitions and targeted small, technology-oriented companies. The company’s intent is to expand newly acquired technologies across its global footprint, while at the same time continuing to roll out new, internally developed technological advancements in its equipment.

NOV has avoided large-scale acquisitions and targeted small, technology-oriented companies. The company’s intent is to expand newly acquired technologies across its global footprint, while at the same time continuing to roll out new, internally developed technological advancements in its equipment. Over the coming years, aging rig fleets must be upgraded and replaced with more modern equipment to cost effectively drill new sources of oil and gas. NOV’s vast global-installed base uniquely positions them to continue to grow through its current advancements, such as automated drilling systems and real-time remote monitoring of equipment with analytics-driven predictive maintenance.

A bright spot has been the small but growing opportunity set in the renewables sector, where NOV is leveraging its core expertise in lifting and handling and in rig architecture to serve the offshore wind industry. These jacking systems and wind turbine installation vessels have a roughly equivalent dollar value to a full equipment package associated with a jack-up oil rig. NOV has been making investments into the wind energy space for nearly 20 years and now sees growing opportunities as a large number of additional wind vessels will be needed over the coming years.

We believe that NOV’s rig and production segments will produce steady growth as the world increasingly seeks oil production from unconventional reservoirs. We expect the company’s asset-light manufacturing processes and continued efficiency improvements will result in low-teens cash flow margins. Based on our assumptions, our financial model indicates that at the current stock price NOV’s stock offers a potential long-term annual return of approximately 10%.

The Goldman Sachs Group, Inc. { GS }

Drawing on over 150 years of experience, Goldman Sachs is a global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base. Clients include corporations, governments and both high- and middle-income individuals. Founded in 1869, the firm is headquartered in New York City and maintains offices in all of the major financial centers around the world. Goldman converted to a bank holding company in 2008 and is regulated by the Federal Reserve.

Goldman’s brand reputation and size provides a competitive advantage for securing investment banking deals and recruiting top talent. The company’s global footprint and scale give it the ability to vie for large cross-border deals that smaller brokerages cannot handle. The firm’s nimble capital allocation is executed with an intense focus on risk management and a long-term outlook. This strategy was key to Goldman’s emergence from the financial crisis in a position of relative strength versus most competitors.

David Solomon was appointed CEO in 2018 after serving as chief operating officer and co-head of investment banking. Since becoming CEO, he has made important changes in the management team, including selecting a new chief financial officer and chief operating officer.

After an initial lackluster foray into consumer banking, which it is now deemphasizing, Goldman has pivoted its growth initiatives and capital toward its asset and wealth management businesses. It wants to grow its management fees and margin through scale and expand product offerings to high-net-worth clients in private equity and real estate.

Goldman imposes equity ownership requirements on all of its partners, which help align their interests with those of common shareholders.

The firm has a deep talent pool made possible by its partnership structure. This unique model does not rely on any one individual rainmaker. Goldman imposes equity ownership requirements on all of its partners, which helps align their interests with those of common shareholders. Goldman’s leadership and legacy in its field attracts a high caliber, diversified group of talent each year. The firm is attracting and hiring a more global and diverse workforce. Half of the newest class of analysts are women and two thirds are from ethnic minorities.

Since the Great Recession of 2008, investment banks have faced increased regulation and higher capital requirements. In response to the new regulatory requirements, Goldman has strengthened its balance sheet by reducing debt, building capital and raising liquidity. Goldman has reallocated capital away from riskier, proprietary investments toward its more client-driven businesses such as investment banking and trading.

A criticism of Goldman is that it has been slow to respond to a decline in trading revenue and changes in the financial markets brought on by new regulatory requirements. Other banks were quicker to materially change their operations by increasing their wealth management operations and de-emphasizing trading. Being identified as a systemically important financial institution with inherent backing by the government brings increased oversight of the company’s operations and restrictions on activities. The offset is that Goldman has gained access to the Federal Reserve lending facilities, which would be especially useful should future shocks to the financial system renew liquidity concerns.

Goldman has maintained a leadership position in most of its activities and is financially stronger and less burdened by irrational competition than it was before the financial crisis. This advantage will be somewhat mitigated by slower global growth, higher regulatory capital requirements and reduced leverage. We believe Goldman will be able to grow revenue in the low single digits on market share gains and expansion in emerging markets. We expect Goldman to generate a return on equity at or over 10% during the next decade. Based on these assumptions, our financial model indicates that at the current stock price Goldman Sach's stock offers a potential long-term annual return of approximately 8%.

Carrier Global Corporation { CARR }

Carrier is a leading provider of HVAC, refrigeration, fire and security solutions. The company’s products promote smarter, safer and more sustainable buildings and infrastructure and help to effectively preserve the freshness, quality and safety of perishables across a variety of industries. Carrier began operating as an independent company as part of a spin-off from United Technologies Corporation (UT) in 2020. The company is led by David Gitlin who previously served as CEO of UT’s Collins Aerospace unit. Carrier has an extensive global footprint with approximately 53,000 employees, including 3,600 engineers. Its products and services are sold in over 160 countries worldwide.

Carrier has released 200 new products during the past couple of years. Carrier also is focused on best environmental practices, and it has reduced waste use by 43% and its carbon footprint by over 40% from 2006.

The primary strength of Carrier is found in its HVAC segment, which provides heating and air products, controls and solutions. The company is advantaged with strong brands, leading positions and scale. The company is a top player within both residential and commercial unitary systems. Carrier has built its leading position through a record of innovation, which continues today. Since 2014, it has increased its engineers by 20% to the current 3,600 count and holds approximately 7,000 patents. Much of this innovation is driven by trends in reducing the carbon footprint and digitization of products from automation and predictive maintenance. Carrier has released 200 new products during the past couple of years. Carrier also is focused on best environmental practices, and it has reduced waste use by 43% and its carbon footprint by over 40% since 2006.

The company’s broad range of product and service offerings, reputation for quality and innovation and its industry-leading brands make it a trusted provider for critical applications in the construction, transportation, security, food retail and pharmaceutical industries, among others. Carrier is focusing investments toward developing smart, sustainable and efficient solutions for mega-trends – according to the company – of urbanization, climate change, increasing requirements for food safety driven by the food needs of our growing global population, rising standards of living and increasing energy and environmental regulations.

Carrier’s large installed base and growing aftermarket revenue mix accounts for over 20% of consolidated revenue. This advantage reduces cyclicality and generates recurring revenue over the lifetime of these systems.

In April 2023, the company announced its intention to acquire the German-based The Viessmann Group and divest its fire, security and commercial refrigeration businesses. Viessman manufactures and sells heat pumps and boilers. Before the acquisition, Carrier had the largest share of commercial heat pumps in Europe. Under the terms of the agreement, Carrier will acquire Viessmann for 12 billion euros of which 80% will be in cash and 20%

in stock.

A slowdown in commercial construction and new housing starts is a cyclical risk facing Carrier and the industry. The company’s strong market position has typically led to a strong recovery after a downturn in building activity. Though typically rational, competition will be an ongoing challenge. Carrier faces reputable competitors that continue to invest to improve their own product lines.

We believe Carrier can grow revenue in the low single digits annually over the next decade. At this pace of growth, we believe cash flow margins will gradually improve to 9%+, over time. Based on these assumptions, our stock valuation model indicates Carrier’s current price offers a long-term average annual rate of return of approximately 14%.

Accenture { ACN }

Accenture is one of the largest information technology (IT) providers in the world, providing solutions for specific enterprise problems as well as strategy and advertising consultancy. The company has a broad top-tier client base, integrating and developing software for 80% of the largest global 500 companies. Of Accenture’s top 100 clients, 98 have been with them for 10 years or more. Accenture achieves sought-after scale and servicing by employing over 700,000 people throughout 200 cities in 51 countries. Customer relationships and multi-industry expertise sets Accenture apart from its peers. The company has approximately 190 clients contributing more than $100 million in annual revenue.

Accenture consistently invests more than $1.0 billion annually in research and development and has over 8,300 patents and pending patent applications.

Many of Accenture’s clients are in the early stages of their digital transformations and recognize that technology is central to their businesses. The firm provides large systems integration for companies, such as Microsoft, Oracle, Salesforce, SAP and Workday. Its engineers customize the software to the client’s needs, building capabilities, connecting databases or adding extra analytics. Accenture’s personnel are often embedded throughout a client’s business. In developing expertise across a wide spectrum, Accenture can develop best industry practices and apply solutions throughout its client base.

Outsourcing is another side of Accenture’s business. It focuses on repeatable business processes, such as data centers, accounting, procurement and application services. After a software integration project, clients can choose to have Accenture manage and maintain the software and systems in various departments. These contracts span several years, and there is significant investment by the client making it difficult for Accenture to be displaced.

The company is continually adapting new technology and services to remain relevant and engaged with its most important customers. Accenture consistently invests more than $1.0 billion annually in research and development and has over 8,300 patents and pending patent applications. At the same time, the company invested $3.4 billion across 38 acquisitions to gain additional skills and talent in high-growth areas of the market. Accenture most recently announced a three-year, $3.0 billion investment in generative Artificial Intelligence (AI) to help clients across all industries achieve greater growth and efficiency. These investments will continue to allow the company to provide cutting edge solutions in AI, blockchain, extended reality, quantum computing, cybersecurity and more. Accenture is well positioned to take advantage of accelerated consulting and outsourcing demand driven by the digitization of the global economy. As a result of internal investment and acquisitions, revenues related to digitization, cloud computing and security have tripled over time and now make up approximately 70% of company revenues.

Like most consulting firms, Accenture is dependent on a high utilization of its employee base. Increasing automation in some of Accenture’s processes may result in lower utilization rates if the company fails to predict its personnel needs. People with high technical skills ultimately drive the business, and employee wage inflation is an emerging concern due to high demand and the shortage of available talent in some geographies.

Based on the financial characteristics we have outlined, we assume that Accenture can grow its revenue at an annual average rate of approximately 6% over the next decade. At this pace of growth and given improved efficiency, we believe operating margins can average 15% during the period. Accordingly, our stock valuation model indicates a long-term annual rate of return of approximately 6%.

Honeywell International Inc. { HON }

Honeywell, one the world’s largest industrial and manufacturing conglomerates, is organized into four diverse segments: Aerospace; Home and Building Technologies; Performance Materials; and Safety and Productivity Solutions. It provides customers with aerospace products, such as jet engines and cockpit controls, security technology for buildings and residences, automotive products, specialty chemicals and process technologies. The broad range of products enables the company to offset risk in any market or region with strength in another. The company’s main themes are energy efficiency, energy generation and industrial safety.

Honeywell is creating and integrating extensive amounts of software to control processes, boost output, cut maintenance costs and improve reliability for itself and for its clients.

Honeywell is creating and integrating extensive amounts of software to control processes, boost output, cut maintenance costs and improve reliability for itself and for its clients. It is leveraging this software technology across its massive industrial installed base. It is embedded in both mission critical operations, such as flight controls, and in customer operations through diverse offerings like warehouse automation and climate control. In aerospace, the company boasts one of the largest installed bases in the industry, including 25,000 engines, 36,000 auxiliary power units, 20,000 wheels and brakes and 20,000 flight management systems. This superior technology stems from its investment in research and development.

Honeywell allocates a high percentage of cash resources to research and development (R&D). R&D spending has averaged over 4% of revenues (roughly twice the industry average) and is targeted at high growth areas to enhance product attributes and differentiation. The U.S. government typically adds an additional 50% to the firm’s R&D funding for defense projects, which pushes spending to nearly 7% of sales.

In addition to new product offerings, Honeywell has become a much more efficient manufacturer over the past 10 years. A number of operating initiatives (Six Sigma, Honeywell Operating System, Functional Transformation, etc.) implemented since 2003 have pushed the company’s key operating metrics towards the upper end of the peer group. On a cumulative basis, the rewards have been transformative. By keeping costs like labor relatively flat, the company generates operating leverage that magnifies returns. Since 2004, operating margins have grown from 7.6% to 21.7% in 2022.

Honeywell’s Aerospace segment, representing nearly 35% of sales, has competitive entry barriers. Once its products, which range from cockpit controls to engines, are integrated into an aircraft, it is difficult for aircraft manufacturers to switch vendors as long as the aircraft is in use. This provides a highly visible recurring revenue stream in the form of maintenance service contracts.

Honeywell has been a very cautious buyer of new businesses. It focuses on small, easy-to-integrate businesses that have the potential to deliver immediate and significant cost savings. Every acquisition must meet a highly specific checklist with an emphasis on integrating the business. On average, Honeywell has paid around 12x earnings for 70 acquired companies and tripled profits.

Based on the financial characteristics outlined, we have assumed that Honeywell can grow its revenue at an average annual rate of over 3% over the next decade. At this pace of growth and given improved operating efficiency, we believe cash flow margins can average 25% during this period. Accordingly, our stock valuation model indicates a long-term annual rate of return of approximately 9%.

Dated: October 1, 2023

Specific securities were included for illustrative purposes based upon a summary of our review during the most recent quarter. Individual portfolios will vary in their holdings over time in relation to others. Information on other individual holdings is available upon request. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. The opinions expressed are subject to change from time to time and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. Any projections are hypothetical in nature, do not reflect actual investment results and are not a guarantee of future results and are based upon certain assumptions subject to change as well as market conditions. Actual results may also vary to a material degree due to external factors beyond the scope and control of the projections and assumptions.